Lily Stock's Email & Phone Number

NYSE: LLY

Lily Stock's Email Addresses

Lily Stock's Phone Numbers

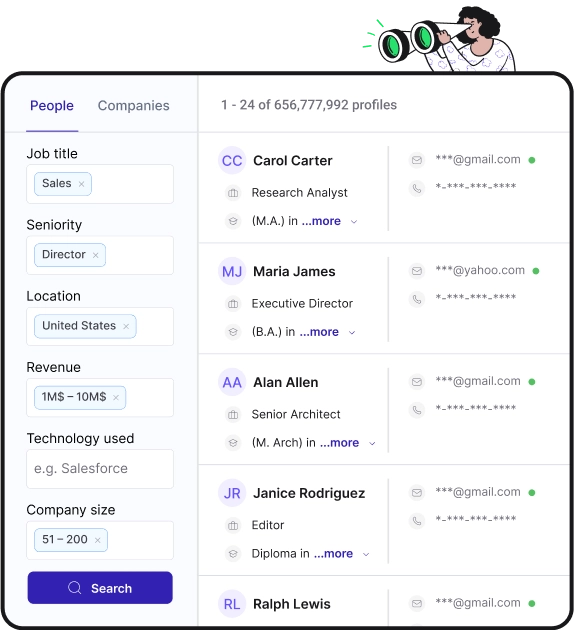

Find personal and work emails for over 300M professionals

Not the Lily Stock you were looking for? Continue your search below:About Lily Stock

📖 Summary

Lily stock, listed on the New York Stock Exchange under the ticker symbol LLY, is a pharmaceutical company that has been a key player in the healthcare industry for over 140 years. The company, founded in 1876 by Colonel Eli Lilly, has a long-standing reputation for innovative drug development and a commitment to improving the lives of patients worldwide.

Lily stock has been a consistent performer in the healthcare sector, with a strong portfolio of pharmaceutical products that address a wide range of medical conditions. The company's robust pipeline of potential new drugs and steady revenue growth has made it an attractive investment for many shareholders. Lily stock also has a reputation for paying regular dividends, making it particularly appealing to income investors.

One of the key strengths of Lily stock is its diversified product portfolio, which includes a variety of drugs for diabetes, cancer, cardiovascular diseases, and other serious medical conditions. The company's flagship product, Trulicity, which is used to treat type 2 diabetes, has been a major driver of the company's growth in recent years. In addition to its strong diabetes franchise, Lily stock has several other high-performing drugs in its portfolio, such as Taltz for psoriasis and Emgality for migraine prevention.

In addition to its established product portfolio, Lily stock has also demonstrated its commitment to innovation and research through strategic partnerships and investments in new technologies. The company has consistently invested a significant portion of its revenue into research and development, with the goal of bringing new, life-changing drugs to market. This commitment to innovation has enabled Lily stock to consistently stay ahead of the competition and maintain its position as a leader in the pharmaceutical industry.

One of the factors that have driven growth for Lily stock is its successful international expansion. The company has a strong presence in key global markets, including Europe, Japan, and China, which has helped to diversify its revenue streams and mitigate risks associated with being overly reliant on any one market. Moreover, Lily stock's global reach has enabled it to tap into new growth opportunities and gain access to a more diverse patient population.

Another key aspect of Lily stock's investment appeal is its strong financial performance. The company's solid balance sheet, healthy cash flow, and low debt levels have made it an attractive investment for many institutional investors. Moreover, Lily stock has consistently reported strong earnings growth, which has been driven by the success of its key products and ongoing cost-saving initiatives.

Furthermore, Lily stock's strong management team has been a key factor in driving the company's success. Under the leadership of CEO David Ricks, the company has been able to effectively navigate the competitive pharmaceutical landscape and position itself for long-term growth. The management team's strategic vision, focus on operational excellence, and commitment to corporate responsibility have been instrumental in driving Lily stock's success and maintaining its status as a leading pharmaceutical company.

In conclusion, Lily stock, listed on the NYSE under the ticker symbol LLY, is a strong and reliable performer in the healthcare sector. With a rich history of innovation, a diversified product portfolio, a commitment to research and development, and a strong international presence, Lily stock is well-positioned for sustained growth and offers an attractive investment opportunity for those looking to gain exposure to the pharmaceutical industry. Whether it's through its strong financial performance, strategic partnerships, or commitment to improving patient outcomes, Lily stock has consistently demonstrated its ability to deliver value to investors and is well-positioned for continued success in the years to come.

Frequently Asked Questions about Lily Stock

Is Eli Lilly a buy sell or hold?

Is LLY a Buy, Sell or Hold? Eli Lilly & Co has a conensus rating of Strong Buy which is based on 19 buy ratings, 1 hold ratings and 0 sell ratings. What is Eli Lilly & Co's price target? The average price target for Eli Lilly & Co is $645.72.

Is Eli Lilly a good dividend stock?

Does Eli Lilly & Co have sufficient earnings to cover their dividend? Yes, LLY's past year earnings per share was $5.42, and their annual dividend per share is $4.52. LLY's dividend payout ratio is 76.35% ($4.52/$5.42) which is sustainable.

How high can Eli Lilly stock go?

Stock Price Forecast The 25 analysts offering 12-month price forecasts for Eli Lilly and Co have a median target of 650.00, with a high estimate of 722.00 and a low estimate of 430.00. The median estimate represents a +8.74% increase from the last price of 597.75.

Lily Stock's Email Addresses

Lily Stock's Phone Numbers

People you may be

interested in

Canadian actress

American comedian

Singer and songwriter

American businesswoman and fashion designer

Author

Duchess of Cambridge

Vocalist

American actress and dancer

American actress

Russian dancer

American singer and songwriter

Developer