Christine Herron Email & Phone Number

Early-stage investor and diversity advocate

Christine Herron Email Addresses

Christine Herron Phone Numbers

Christine Herron's Work Experience

Bullpen Capital

Advisor

January 2016 to Present

Goldbely.com

Board Of Directors

June 2013 to October 2018

E la Carte Inc.

Board Of Directors

March 2013 to October 2018

Jelli

Board Of Directors

September 2011 to October 2018

Storenvy

Board Of Directors

January 2013 to September 2014

Better Finance, Inc. (formerly BillFloat, Inc.)

Board Observer

July 2010 to October 2010

Outright.com

Board Observer

January 2009 to October 2010

Mission Research

Vice President of Marketing and Acting President

February 2003 to May 2005

Cycle Partners

Principal

February 2001 to May 2005

Mercury2

Founder and CEO

June 1999 to January 2001

Geocapital Partners

Associate

February 1992 to August 1995

Show more

Show less

Christine Herron's Education

Stanford University Graduate School of Business

Master of Business Administration (M.B.A.)

Columbia University in the City of New York

Bachelor's Degree, English, Premed

Show more

Show less

Frequently Asked Questions about Christine Herron

What is Christine Herron email address?

Email Christine Herron at [email protected], [email protected] and [email protected]. This email is the most updated Christine Herron's email found in 2024.

What is Christine Herron phone number?

Christine Herron phone number is +1.4152257869, 415-503-0531, 5103863396 and 4156727029.

How to contact Christine Herron?

To contact Christine Herron send an email to [email protected], [email protected] or [email protected]. If you want to call Christine Herron try calling on +1.4152257869, 415-503-0531, 5103863396 and 4156727029.

What company does Christine Herron work for?

Christine Herron works for 500 Startups

What is Christine Herron's role at 500 Startups?

Christine Herron is Venture Advisor

What industry does Christine Herron work in?

Christine Herron works in the Venture Capital & Private Equity industry.

Christine Herron's Professional Skills Radar Chart

Based on our findings, Christine Herron is ...

What's on Christine Herron's mind?

Based on our findings, Christine Herron is ...

Christine Herron's Estimated Salary Range

Christine Herron Email Addresses

Christine Herron Phone Numbers

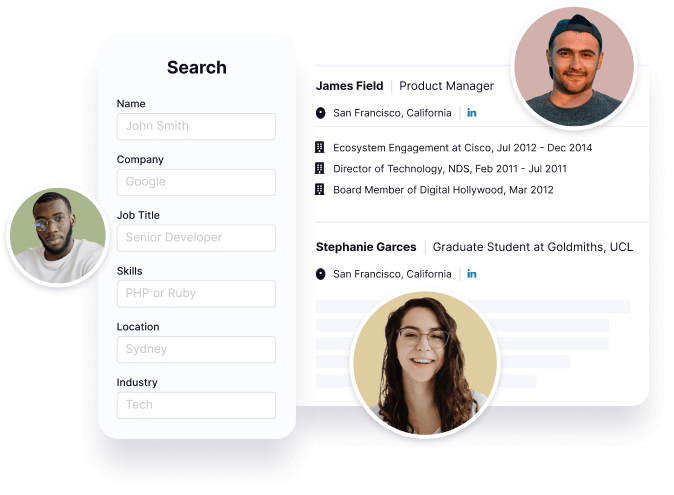

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Christine Herron's Ranking

Ranked #1,153 out of 23,060 for Venture Advisor in California

Christine Herron's Personality Type

Extraversion (E), Sensing (S), Thinking (T), Perceiving (P)

Average Tenure

2 year(s), 0 month(s)

Christine Herron's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 86% chance that Christine Herron is seeking for new opportunities

Christine Herron's Social Media Links

/in/christineherron /company/bullpen-capital /school/stanford-graduate-school-of-business/