Benjamin Wey's Email & Phone Number

FINANCIER, INVESTIGATIVE JOURNALIST. CEO, NEW YORK GLOBAL GROUP, PRIVATE EQUITY. COLUMBIA UNIVERSITY - 2 MASTERS DEGREES

Benjamin Wey Email Addresses

Benjamin Wey Phone Numbers

Benjamin Wey's Work Experience

New York Global Group - A Leading Wall Street Investment Firm

CEO

January 2002 to Present

New York Global Group

CEO, Member of the Executive Committee 纽约国际集团总裁兼集团管理委员会委员

January 2002 to January 2019

TheBlot Magazine

Marketing Advisor

August 2013 to January 2014

New York Global Group

Leading Wall Street Firm

CEO - New York Global Group

Show more

Show less

Benjamin Wey's Education

Columbia University in the City of New York

University of Central Oklahoma

University of Petroleum (East China)

Columbia University - Columbia Business School

University of Maryland College Park

Oklahoma Baptist University

Show more

Show less

Frequently Asked Questions about Benjamin Wey

What is Benjamin Wey email address?

Email Benjamin Wey at [email protected]. This email is the most updated Benjamin Wey's email found in 2024.

What is Benjamin Wey phone number?

Benjamin Wey phone number is +1.2125660499 and +1.2125133470.

How to contact Benjamin Wey?

To contact Benjamin Wey send an email to [email protected]. If you want to call Benjamin Wey try calling on +1.2125660499 and +1.2125133470.

What company does Benjamin Wey work for?

Benjamin Wey works for New York Global Group - A Leading Wall Street Investment Firm

What is Benjamin Wey's role at New York Global Group - A Leading Wall Street Investment Firm?

Benjamin Wey is CEO

What industry does Benjamin Wey work in?

Benjamin Wey works in the Financial Services industry.

Benjamin Wey's Professional Skills Radar Chart

Based on our findings, Benjamin Wey is ...

What's on Benjamin Wey's mind?

Based on our findings, Benjamin Wey is ...

Benjamin Wey's Estimated Salary Range

Benjamin Wey Email Addresses

Benjamin Wey Phone Numbers

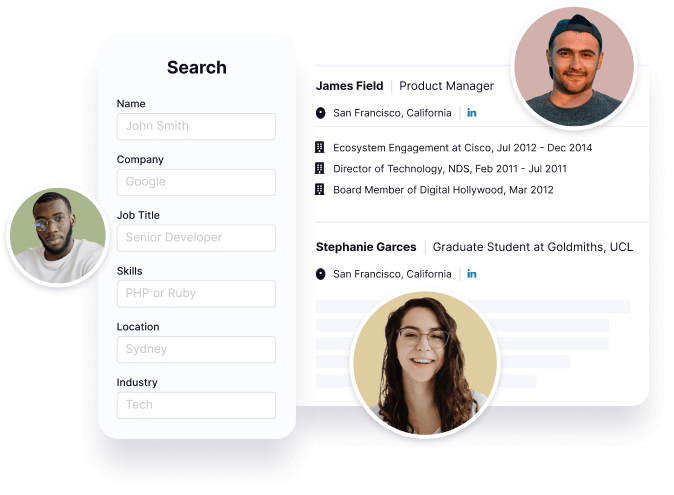

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Benjamin Wey's Ranking

Ranked #395 out of 7,899 for CEO in New York

Benjamin Wey's Personality Type

Extraversion (E), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Benjamin Wey's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 78% chance that Benjamin Wey is seeking for new opportunities

Top Searched People

American actress

South African journalist and author

Cuban-Turkish volleyball player

Internet personality

Singer

Benjamin Wey's Social Media Links

/in/benjaminwey www.nyggroup.com www.benjaminwey.com www.benjaminwey.net