Michael Burry's Email & Phone Number

American investor

Michael Burry's Email Addresses

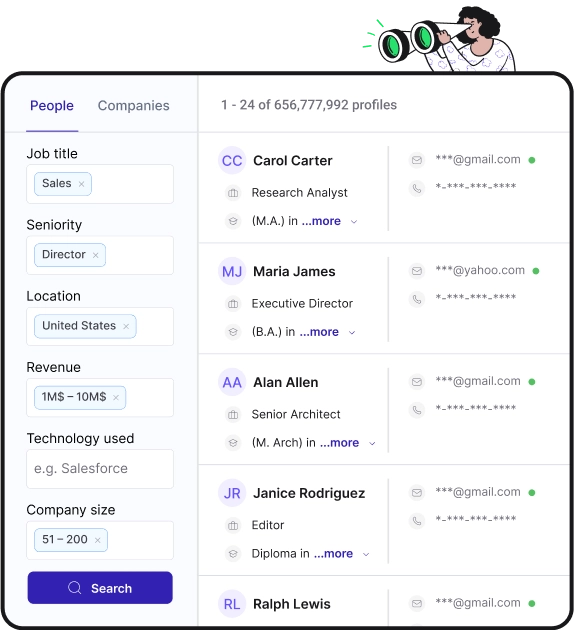

Find personal and work emails for over 300M professionals

Not the Michael Burry you were looking for? Continue your search below:About Michael Burry

📖 Summary

Michael Burry is an American investor who has earned legendary status in the world of finance. Known for his remarkable foresight and unconventional strategies, Burry gained widespread recognition after he successfully predicted and profited from the 2008 subprime mortgage crisis. His story, immortalized in the book and subsequent Academy Award-winning film "The Big Short," showcases his brilliance and determination as an investor.

Born on June 19, 1971, in San Jose, California, Burry displayed an early affinity for numbers and analysis. As a child, he would spend hours poring over the stock tables in the newspaper and memorizing baseball statistics. This fascination with data stayed with him as he pursued a wide range of interests, including science, mathematics, and economics.

In 1999, Burry founded the hedge fund Scion Capital LLC with a small investment of $1 million. His ability to identify and analyze undervalued assets quickly became his defining skill. Burry became particularly interested in the subprime mortgage market, sensing an impending crisis that others overlooked. He conducted extensive research, scrutinizing loan documents and conducting in-depth analysis to expose the flaws in the housing market. Despite facing skepticism and ridicule from industry insiders, Burry bet against the housing market, making a series of credit default swaps – a financial instrument that allowed him to profit if the market collapsed.

As the financial crisis unfolded in 2008, Burry's bet paid off spectacularly. Scion Capital saw a staggering return of over 490%, transforming his small hedge fund into one of the most successful of its time. Burry's prescience and courageous investment approach placed him in the ranks of other legendary investors like Warren Buffett and George Soros.

Burry's investing style is often characterized by his willingness to go against the grain and challenge the status quo. He possesses a unique ability to identify hidden opportunities and assess risk from a different perspective. Burry has been known to immerse himself in complex financial data and work tirelessly to uncover hidden value in the markets. His meticulous research and contrarian approach allow him to spot undervalued assets that others may overlook.

However, Burry's investment career has been marked by controversy and criticism as well. His abrasive personality and uncompromising nature have sometimes clashed with other professionals in the industry. Burry's authenticity and refusal to conform to conventional norms have earned him both admirers and detractors.

After successfully navigating the financial crisis, Burry shifted his focus to personal investment and philanthropy. Despite his immense success, he chose to live a modest lifestyle in Palo Alto, California. Burry launched a new venture called Scion Asset Management, which allowed him to manage his personal wealth and make strategic investments.

Burry's investment philosophy revolves around individual empowerment and understanding that markets are not always efficient. He encourages investors to think independently and question prevailing wisdom. His life and career are a testament to the pursuit of knowledge, the power of conviction, and the willingness to take risks for potential rewards.

In addition to his contributions to the world of finance, Burry is an active philanthropist. He has donated substantial amounts to charitable causes, focusing on education and healthcare initiatives. Burry is deeply committed to making a positive impact on society and using his success to uplift others.

Today, Michael Burry continues to be a fascinating figure in the investment community. His success story serves as a reminder to think critically and challenge established norms. Burry's contrarian approach and ability to foresee major market movements have solidified his status as one of the most impactful and controversial investors of our time. As the financial landscape continues to evolve, one can only wonder what extraordinary opportunities Michael Burry will uncover next.

Frequently Asked Questions about Michael Burry

Is Michael Burry a billionaire?

As of April 2023, Michael Burry's net worth was estimated to be around $1.2 billion, making him one of only several thousand billionaires on the planet. Interestingly, this figure could be significantly higher if it weren't for the timing of a single trade. Sep 21, 2023

How much did Michael Burry make in the big short?

Michael Burry, the central character in The Big Short, made $100 million for himself and $725 million for his investors by shorting market-based mortgage-backed securities and accurately predicting the 2007 housing market crash.

What are Michael Burry's current investments?

In Michael Burry's portfolio as of 30 Jun 2023, the top 5 holdings are (EXPE) EXPEDIA GROUP INC (9.82%), (CHTR) CHARTER COMMUNICATIONS INC-A (8.25%), (GNRC) GENERAC HOLDINGS INC (7.37%), (CI) CIGNA CORP (6.93%) and (CVS) CVS HEALTH CORP (6.21%).

Why does Michael Burry invest in water?

He prefers water-rich farmland away from large governmental and infrastructural limitations. Burry has said in interview: “What became clear to me is that food is the way to invest in water. That is, grow food in water-rich areas and transport it for sale in water-poor areas.

Michael Burry's Email Addresses

People you may be

interested in

American artist and musician

Internet personality

Influencer ‧ Travis Barker's son

Football wide receiver

American singer and songwriter

American investor

Captain - Global 6000 Vision

CEO bei Oberhauser.com . International SEO & Google Performance Marketing Agency

Chief Economist at Atlas Capital Team L.P.

--writer/director/composer

IT Project Manager

Warren Buffett's wife