Frederic BIZIERE's Email & Phone Number

Group Management Board at Euler Hermes: Helping companies expand their business worldwide by securing their receivables

Frederic BIZIERE Email Addresses

Frederic BIZIERE's Work Experience

Group Management Board - Market Management, Commercial Underwriting, Distribution

September 2011 to December 2012

Banque Française du Commerce Extérieur

Head of Controlling for the International Business Division

September 1995 to November 1998

KPMG Audit

Senior Auditor

September 1992 to August 1995

Group Management Board: Credit Intelligence (Assessment, Underwriting, Collections), Reinsurance

Show more

Show less

Frederic BIZIERE's Education

Ecole des Hautes Etudes Commerciales

January 1987 to January 1991

Lycée Privé Sainte Geneviève

January 1985 to January 1987

Show more

Show less

Frequently Asked Questions about Frederic BIZIERE

What is Frederic Biziere email address?

Email Frederic Biziere at [email protected]. This email is the most updated Frederic Biziere's email found in 2024.

How to contact Frederic Biziere?

To contact Frederic Biziere send an email to [email protected].

What company does Frederic BIZIERE work for?

Frederic BIZIERE works for Euler Hermes

What is Frederic BIZIERE's role at Euler Hermes?

Frederic BIZIERE is Head of Accounting

What is Frederic BIZIERE's Phone Number?

Frederic BIZIERE's phone (**) *** *** 166

What industry does Frederic BIZIERE work in?

Frederic BIZIERE works in the Insurance industry.

Frederic BIZIERE Email Addresses

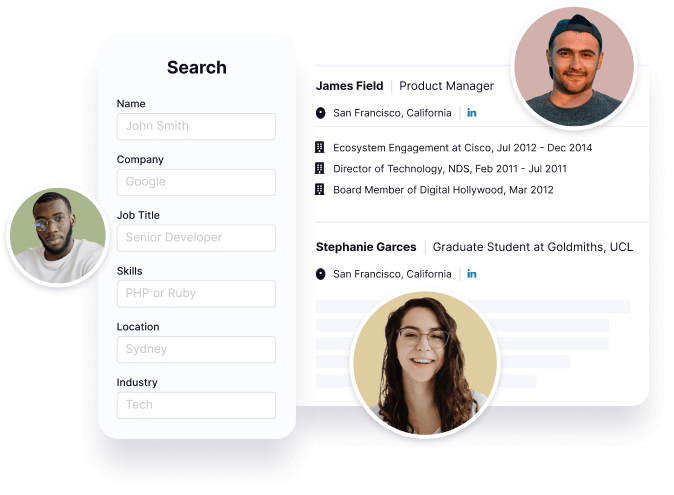

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Frederic BIZIERE's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Frederic BIZIERE's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 73% chance that Frederic BIZIERE is seeking for new opportunities

Frederic BIZIERE's Social Media Links

/in/fredericbiziere