Dominic Lavelle's Email & Phone Number

Group CFO at SDL plc

Dominic Lavelle Email Addresses

Dominic Lavelle's Work Experience

Group CFO

European Care Group

CRO

Interim CFO

CRO

Blacks Leisure Group plc

Finance Director

Chief Restructuring Officer (reporting to Chairman)

GLADEDALE GROUP

Chief Restructuring Officer (reporting to Chairman)

ERINACEOUS GROUP plc/CALEY LIMITED

Group Finance Director (reporting to CEO)

ALFRED MCALPINE plc

Group Finance Director

ALLDERS plc

Group Finance Director

OASIS STORES plc

Finance Director and Company Secretary

LAURA ASHLEY HOLDINGS plc

1996-1997 Finance Director – UK and Europe, 1994-1996 Group Financial Controller

Show more

Show less

Dominic Lavelle's Education

The University of Sheffield

BEng Civil & Structural Engineering

Show more

Show less

Frequently Asked Questions about Dominic Lavelle

What is Dominic Lavelle email address?

Email Dominic Lavelle at [email protected]. This email is the most updated Dominic Lavelle's email found in 2024.

How to contact Dominic Lavelle?

To contact Dominic Lavelle send an email to [email protected].

What company does Dominic Lavelle work for?

Dominic Lavelle works for SDL plc

What is Dominic Lavelle's role at SDL plc?

Dominic Lavelle is Group CFO

What is Dominic Lavelle's Phone Number?

Dominic Lavelle's phone +44 ** **** *390

What industry does Dominic Lavelle work in?

Dominic Lavelle works in the Retail industry.

Dominic Lavelle's Professional Skills Radar Chart

Based on our findings, Dominic Lavelle is ...

What's on Dominic Lavelle's mind?

Based on our findings, Dominic Lavelle is ...

Dominic Lavelle's Estimated Salary Range

Dominic Lavelle Email Addresses

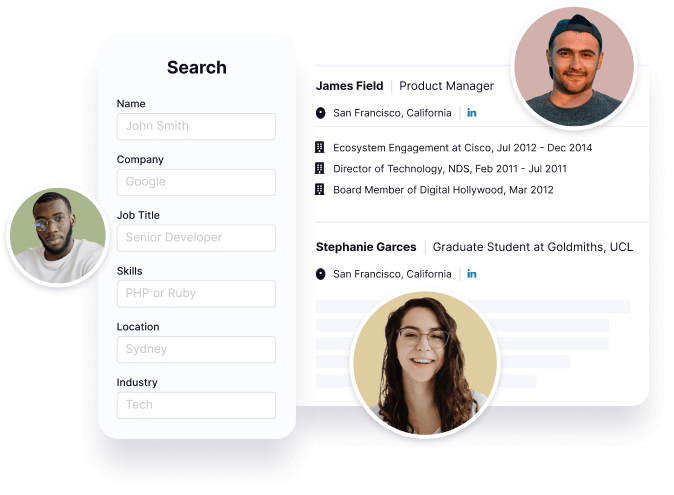

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Dominic Lavelle's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Dominic Lavelle's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 76% chance that Dominic Lavelle is seeking for new opportunities

Top Searched People

American saxophonist and multi-instrumentalist

American professional golfer

South African media personality and host

English former soccer player

American artist

Dominic Lavelle's Social Media Links

/in/dominic-lavelle-15a55447