Michael Kaplan's Email & Phone Number

American costume designer

Michael Kaplan's Email Addresses

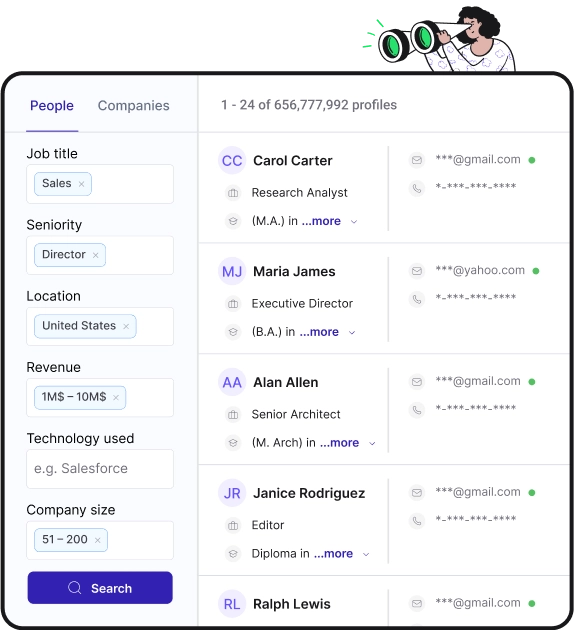

Find personal and work emails for over 300M professionals

Not the Michael Kaplan you were looking for? Continue your search below:About Michael Kaplan

📖 Summary

Michael Kaplan is a renowned American costume designer whose work has graced the big screen in some of the most iconic films of the past few decades. With a career spanning over 30 years, Kaplan has solidified his reputation as a master of his craft, creating visually stunning and memorable costumes that have brought characters to life on the silver screen.

Kaplan's early work in the film industry included collaborating with director John Carpenter on the cult classic film "Fight of the Navigator," which showcased his unique and imaginative approach to costume design. His keen eye for detail and ability to capture the essence of a character through clothing quickly earned him a reputation as a rising talent in the industry.

One of Kaplan's most notable collaborations came in 1987, when he worked with director David Lynch on the groundbreaking film "Fatal Attraction." Kaplan's costumes for actress Glenn Close's character were instrumental in conveying the complex emotions and psychological depth of the film's central character, and his work contributed greatly to the film's critical and commercial success.

In 1989, Michael Kaplan made a significant impact on the world of cinema with his work on the science fiction classic "Blade Runner." His futuristic and innovative costume designs for the film helped create a visually immersive and groundbreaking world that has influenced countless films since its release. Kaplan's ability to seamlessly blend high fashion with futuristic elements set a new standard for what could be achieved in costume design, and his work on "Blade Runner" remains a cornerstone of his impressive body of work.

Kaplan's talent for creating memorable and impactful costume designs continued to shine in the 1990s, as he worked on a diverse range of films, from the high-octane action of "Armageddon" to the period drama of "Great Expectations." With each project, Kaplan demonstrated his versatility and ability to adapt his designs to suit the tone and style of the film, solidifying his reputation as one of the most sought-after costume designers in Hollywood.

One of Michael Kaplan's most celebrated collaborations came in 2015, when he worked on the highly anticipated "Star Wars: The Force Awakens." As the costume designer for the film, Kaplan was tasked with creating new looks for beloved characters as well as introducing new ones into the iconic Star Wars universe. His designs for characters like Rey and Kylo Ren were met with widespread praise from fans and critics alike, with many praising his ability to pay homage to the original trilogy while also adding fresh and modern elements to the costumes.

Throughout his career, Michael Kaplan has consistently pushed the boundaries of costume design, bringing his unparalleled vision and creativity to each project he takes on. His ability to capture the essence of a character and convey their emotions and motivations through clothing has made him a standout talent in the industry, earning him numerous accolades and a reputation as one of the preeminent costume designers in the world of cinema.

In conclusion, Michael Kaplan's illustrious career as a costume designer has left an indelible mark on the world of film, with his innovative and visually stunning designs continuing to captivate audiences to this day. His talent for creating immersive and impactful costumes has made him an invaluable collaborator for some of the most esteemed directors in the industry, and his work continues to set the standard for what can be achieved in the realm of costume design. With a career defined by creativity, passion, and an unwavering commitment to his craft, Michael Kaplan's influence on the world of cinema is truly immeasurable.

Frequently Asked Questions about Michael Kaplan

What is Michael Kaplan known for?

Michael Kaplan was born in Philadelphia, Pennsylvania, USA. He is known for Armageddon (1998), Blade Runner (1982) and Star Trek (2009).

Who appointed Judge Michael Kaplan?

Judge Kaplan has been appointed by the Director of Administrative Office of the Courts (“AO”) to a term as the Third Circuit representative to the Bankruptcy Judges Advisory Group, in addition to appointments as the Bankruptcy Judge representative on both the Human Resources Advisory Council and Budget & Finance ...

Michael Kaplan's Email Addresses

People you may be

interested in

Actor

Romanian-American actor

Actor

English singer

TV personality

TV personality

Broadcaster and journalist

American actress and talk show host

American online streamer and YouTuber

Canadian professional wrestler and actress

American former YouTuber

TV personality