James Dixon's Email & Phone Number

Customer Marketing and CRM at Virgin Media

James Dixon's Email Addresses

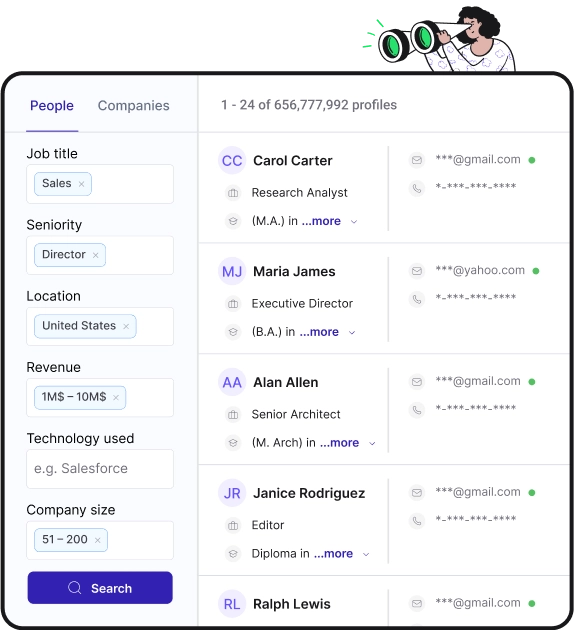

Find personal and work emails for over 300M professionals

Not the James Dixon you were looking for? Continue your search below:About James Dixon

📖 Summary

James Dixon is a highly skilled and experienced Customer Marketing and CRM professional at Virgin Media, where he has been instrumental in driving customer engagement and loyalty. With a deep understanding of the telecommunications industry and a passion for delivering exceptional customer experiences, James has played a pivotal role in shaping Virgin Media's marketing and CRM strategies.

In his role at Virgin Media, James is responsible for developing and implementing customer marketing initiatives that effectively target and engage Virgin Media's customer base. By leveraging data-driven insights and customer segmentation strategies, he has been able to create personalized and relevant communications that resonate with customers and drive desired outcomes. James is also responsible for overseeing Virgin Media's CRM platform, ensuring that it effectively captures and utilizes customer data to deliver seamless and consistent experiences across all touchpoints.

James is known for his strategic mindset and his ability to identify opportunities for growth and improvement within Virgin Media's customer marketing and CRM efforts. He has successfully implemented campaigns and initiatives that have resulted in increased customer retention, cross-sell and up-sell opportunities, and overall customer satisfaction. His in-depth knowledge of customer behavior and preferences has allowed him to tailor marketing communications and offers that are not only compelling but also resonate with Virgin Media's diverse customer base.

One of James' key strengths lies in his ability to collaborate cross-functionally and build strong relationships with internal stakeholders. By working closely with sales, product, and customer service teams, he has been able to align customer marketing and CRM efforts with broader business goals and objectives. This collaborative approach has enabled Virgin Media to deliver consistent and cohesive messaging to customers, ultimately enhancing the overall customer experience and driving business results.

In addition to his strategic and collaborative approach, James is also a strong advocate for leveraging technology and data to drive customer marketing and CRM efforts. He has been at the forefront of implementing cutting-edge marketing automation and CRM tools at Virgin Media, enabling the company to target customers with precision and deliver personalized experiences at scale. By harnessing the power of data analytics and customer insights, James has been able to optimize marketing campaigns and strategies, resulting in improved ROI and customer engagement.

Overall, James Dixon brings a wealth of knowledge and expertise to the customer marketing and CRM function at Virgin Media. His strategic mindset, collaborative approach, and passion for leveraging technology and data have been instrumental in driving customer engagement and loyalty. With his leadership and contributions, Virgin Media has been able to deliver personalized and compelling experiences to its customers, ultimately driving business success in a highly competitive industry.

James Dixon's Email Addresses

People you may be

interested in

British singer and pianist

Canadian-American actor

American actress and writer

American singer-songwriter and record producer

Football coach

American actress and singer

Irish professional wrestler

American comedian and actor

Internet personality

Duchess of Cambridge

Football quarterback

CEO of the New England Patriots