David Cho's Email & Phone Number

American artist and musician

David Cho's Email Addresses

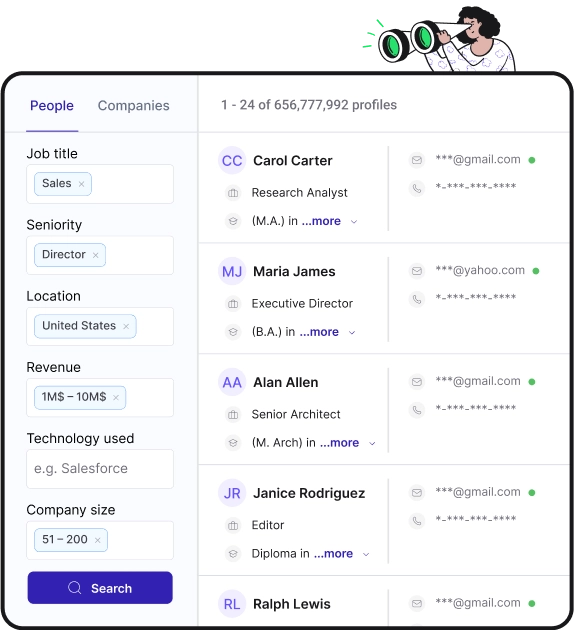

Find personal and work emails for over 300M professionals

Not the David Cho you were looking for? Continue your search below:About David Cho

📖 Summary

David Cho is a multi-talented American artist and musician known for his unique blend of visual art and music. Born and raised in New York City, Cho's work is heavily influenced by the diverse urban landscape that surrounded him growing up. He has gained a considerable following for his captivating artwork and compelling musical compositions, each of which reflects his distinct perspective on life and the world around him.

As an artist, Cho's work is characterized by his bold use of color and dynamic compositions. His paintings and drawings often combine elements of graffiti, street art, and abstract expressionism, creating a visually striking and emotionally evocative aesthetic. Many of his pieces explore themes of identity, urban culture, and the human experience, drawing from his own personal experiences and observations. Cho's art has been featured in numerous galleries and exhibitions across the country, and his work is highly sought after by collectors and enthusiasts alike.

In addition to his visual art, Cho is also an accomplished musician and composer. He is a skilled guitarist and vocalist, and his music is a reflection of his eclectic taste and diverse influences. His songs are a blend of rock, soul, and hip-hop, and his powerful lyrics and soulful melodies have resonated with audiences around the world. Cho's music often addresses themes of love, struggle, and self-discovery, and his raw and emotional performances have earned him a loyal fanbase.

What sets David Cho apart from other artists and musicians is his ability to seamlessly blend his visual and musical talents. He often incorporates his own artwork into his music videos and album artwork, creating a cohesive and immersive experience for his audience. This unique approach allows Cho to fully express himself and share his creativity in a way that is both visually and sonically impactful.

In addition to his solo work, Cho has collaborated with a wide range of artists and musicians, bringing his distinct style and perspective to various projects. He has also been involved in community arts initiatives, using his talents to empower and inspire others. Whether through his art, music, or community involvement, David Cho continues to make a meaningful impact on the creative world and beyond.

Overall, David Cho is a truly one-of-a-kind artist and musician whose work is both visually stunning and emotionally resonant. His ability to seamlessly blend his two passions has allowed him to create a powerful and immersive artistic experience that captivates and inspires audiences around the world. With his bold creativity and unwavering authenticity, Cho is sure to continue making waves in the art and music industries for years to come.

Frequently Asked Questions about David Cho

What happened to David Choe?

After receiving extensive therapy and treatment, he reemerged in 2017 with a new body of work and an exhibition in Los Angeles that presented heavy themes of trauma, self-reflection and hope for recovery. In 2023, Choe starred as Isaac Cho in the Netflix drama-comedy miniseries Beef, alongside Ali Wong and Steven Yeun.

How much is David Choe's art worth?

David Choe's work has been offered at auction multiple times, with realized prices ranging from 199 USD to 32,760 USD, depending on the size and medium of the artwork.

Who was the artist who got rich from Facebook?

9, 2012— -- David Choe, the 35-year-old muralist who made an estimated $200 million in the Facebook IPO, is bothered by the hype surrounding his newfound money. "You can't buy your privacy back," Choe told Barbara Walters.Feb 9, 2012

Who was the Facebook artist paid in stock?

David Choe was persuaded by Facebook's founding president Sean Parker to do the work in exchange for stock when the company was just a start-up. David Choe, the artist who painted the Facebook Incorporation building in 2005, was not paid in cash.Jun 10, 2015

David Cho's Email Addresses

People you may be

interested in

American YouTuber and author

American baseball pitcher

Welsh comedian

American actress

American rapper and comedian

American singer-songwriter

Internet personality ‧ Irfan Bachdim's wife

TV personality ‧ Tyler Johnson's wife

American actress

American singer and actress

Drummer

Indian actress