Brian Kelly's Email & Phone Number

Football coach

Brian Kelly's Email Addresses

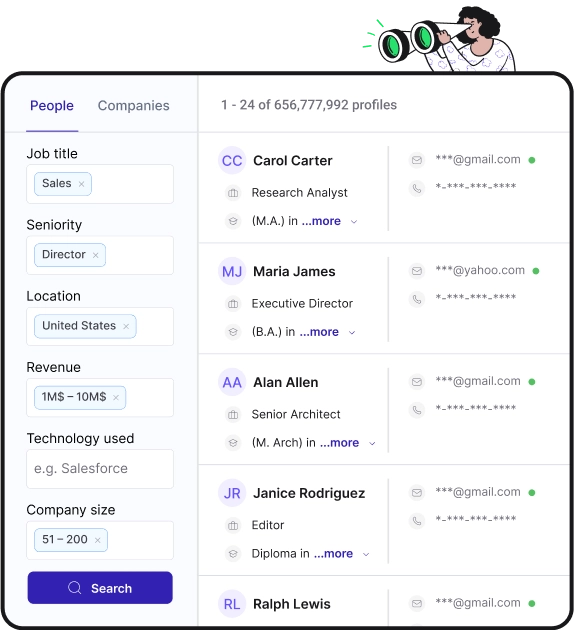

Find personal and work emails for over 300M professionals

Not the Brian Kelly you were looking for? Continue your search below:About Brian Kelly

📖 Summary

Brian Kelly is an accomplished football coach who has made a significant impact on the sport throughout his career. Known for his strategic approach and ability to build strong teams, Kelly has built a reputation as one of the most successful coaches in the game today. With a remarkable track record and a commitment to excellence, he has led his teams to numerous victories and championship games.

Born on October 25, 1961, in Everett, Massachusetts, Kelly's journey into the world of football began at a young age. He developed a passion for the sport during his high school years and continued to pursue his passion in college. After receiving a bachelor's degree in political science from Assumption College, he embarked on his coaching career as a graduate assistant at his alma mater.

Throughout his early coaching years, Kelly honed his skills and gained valuable experience at various colleges and universities. He coached at Grand Valley State University, where he had his first head coaching position. Under his leadership, the team experienced tremendous success, winning two NCAA Division II championships in 2002 and 2003. These victories solidified his reputation as a talented coach and caught the attention of the football community.

In 2010, Brian Kelly joined the University of Notre Dame, one of the most prestigious college football programs in the country. Taking over a struggling team, Kelly faced the daunting task of rebuilding and restoring the program to its former glory. Through his innovative strategies and unwavering determination, he led Notre Dame to an impressive turnaround, transforming them into a formidable force.

Under Kelly's guidance, the Fighting Irish became known for their strong defensive play and disciplined approach to the game. He emphasized the importance of developing well-rounded student-athletes, with a focus on academic excellence and personal growth. Kelly's commitment to character development and integrity has been fundamental in shaping the values of his players on and off the field.

The highlights of Kelly's tenure at Notre Dame include a trip to the 2012 BCS National Championship game, where the Irish faced the Alabama Crimson Tide. Although they fell short in that game, it was a remarkable accomplishment for a team that had struggled just a few years prior. Kelly's ability to guide his team to the national stage demonstrated his exceptional leadership and coaching skills.

Throughout the years, Kelly has received numerous accolades for his coaching prowess. He has been named national coach of the year multiple times, including the Home Depot Coach of the Year in 2012. However, his success is not solely measured by awards and trophies. His impact on the lives of his players extends far beyond the field. Many of his former players credit him for their personal growth and development as individuals.

In addition to his success at Notre Dame, Kelly has shown his adaptability and versatility by making successful coaching transitions to the National Football League (NFL). In 2021, he accepted the position as the head coach of the Philadelphia Eagles, joining the ranks of the elite coaches in the professional league. This move reflects not only his acumen for the game but also his willingness to take on new challenges and continue growing as a coach.

In conclusion, Brian Kelly's career as a football coach has been marked by his ability to uplift struggling teams, instill discipline and character, and achieve remarkable success. His strategic approach, commitment to excellence, and dedication to player development have set him apart in the world of football. From his early days at Grand Valley State to his current role in the NFL, Kelly's influence on the sport has been significant and enduring. His impact as a coach goes beyond the victories and championships, as he leaves a lasting legacy of integrity, leadership, and personal growth.

Frequently Asked Questions about Brian Kelly

Is Brian Kelly related to Chip Kelly?

In conclusion, Brian Kelley and Chip Kelly are unrelated individuals with distinct backgrounds and careers in the world of sports. Brian Kelley is renowned for his successful coaching tenure at the University of Notre Dame, while Chip Kelly stands out for his innovative coaching style and stints with various NFL teams.

Brian Kelly's Email Addresses

People you may be

interested in

Canadian actor and filmmaker

American basketball player

American singer and actress

American actor and comedian

Football running back

American actress

American professional wrestler and musician

American host and television producer

CEO at Dribbble

Jornalista. Colunista na Gazeta do Povo. Comentarista Revista Oeste.

Director Cash Sales,Aberdeen Asset Management PLC

Buyer at Knight Group (Est.1977)