Tomas Hazleton's Email & Phone Number

CRO-SMF4, CCO-SMF16 & MLRO-SMF17 available for Permanent, Interim & NED roles

Tomas Hazleton Email Addresses

Tomas Hazleton Phone Numbers

Tomas Hazleton's Work Experience

RiskCompliance Associates Limited (Founding Director & Consultant)

Transformational Leader of Risk, Compliance and Anti-Financial Crime

November 2020 to Present

Permanent, Interim & NED

Exploring Opportunities

August 2021 to Present

Allica

Chief Risk & Compliance Officer and MLRO (SMF4, SMF16, SMF17 & DPO)

February 2018 to January 2019

UK Challenger Banks & Fintechs

Exploring Opportunities

February 2017 to January 2018

Threadneedle Investments

Head of Corporate & Operational Risk (Contract role)

July 2013 to April 2014

GAM

Head of Risk & Board Member (CF28/CF1)

June 2012 to July 2013

Bank of America

EMEA Director of Risk Management-Global Wealth and Investment Management (GWIM)

January 2011 to September 2011

General Motors Asset Management

Director of Enterprise Risk Management

March 2005 to February 2006

Depository Trust & Clearing Corporation (DTCC)

Vice-President, Strategy

February 2001 to September 2004

Show more

Show less

Tomas Hazleton's Education

Columbia Business School

January 1989 to January 1991

Rutgers University

January 1984 to January 1989

Show more

Show less

Frequently Asked Questions about Tomas Hazleton

What is Tomas Hazleton email address?

Email Tomas Hazleton at [email protected], [email protected] and [email protected]. This email is the most updated Tomas Hazleton's email found in 2024.

What is Tomas Hazleton phone number?

Tomas Hazleton phone number is 07 563 563 664.

How to contact Tomas Hazleton?

To contact Tomas Hazleton send an email to [email protected], [email protected] or [email protected]. If you want to call Tomas Hazleton try calling on 07 563 563 664.

What company does Tomas Hazleton work for?

Tomas Hazleton works for Permanent, Interim & NED

What is Tomas Hazleton's role at Permanent, Interim & NED?

Tomas Hazleton is Exploring Opportunities

What industry does Tomas Hazleton work in?

Tomas Hazleton works in the Banking industry.

Tomas Hazleton's Professional Skills Radar Chart

Based on our findings, Tomas Hazleton is ...

What's on Tomas Hazleton's mind?

Based on our findings, Tomas Hazleton is ...

Tomas Hazleton's Estimated Salary Range

Tomas Hazleton Email Addresses

Tomas Hazleton Phone Numbers

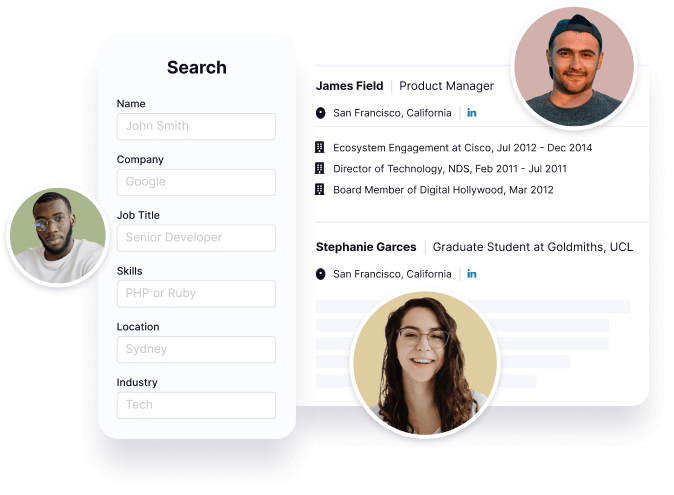

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Tomas Hazleton's Personality Type

Extraversion (E), Sensing (S), Feeling (F), Perceiving (P)

Average Tenure

2 year(s), 0 month(s)

Tomas Hazleton's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 89% chance that Tomas Hazleton is seeking for new opportunities

Top Searched People

American television writer and producer

United States Representative

American erotic dancer

American actress

American actress

Tomas Hazleton's Social Media Links

/in/tomas-hazleton-75419913