Sasha Talebi's Email & Phone Number

Founder and Managing Partner at Sequence Venture Group, LLC

Sasha Talebi Email Addresses

Sasha Talebi Phone Numbers

Sasha Talebi's Work Experience

Sequence Venture Group, LLC

Founder and Managing Partner

Somnus Labs

Board Member

MondoTunes

Board Advisor

Board Member

Armored Wolf LLC

Managing Director

US Family Office

Executive Director, Corporate Development

CFVM Alternative Investments

Managing Director

European Family Office

Managing Director

Infiniti Capital AG

Senior Analyst, Americas

Veros Software

Chief Operating Officer (Veros Capital Management)

Core Venture Partners

Vice President

VP, Research

Conexant (fka Rockwell Semiconductor Systems)

Analyst, Mergers and Acquisitions

Show more

Show less

Sasha Talebi's Education

University of California, Irvine - The Paul Merage School of Business

MBA International Finance and Information Technology

University of California, Irvine

BS Astrophysics Mathematics

Show more

Show less

Frequently Asked Questions about Sasha Talebi

What is Sasha Talebi email address?

Email Sasha Talebi at [email protected]. This email is the most updated Sasha Talebi's email found in 2024.

How to contact Sasha Talebi?

To contact Sasha Talebi send an email to [email protected].

What company does Sasha Talebi work for?

Sasha Talebi works for Sequence Venture Group, LLC

What is Sasha Talebi's role at Sequence Venture Group, LLC?

Sasha Talebi is Founder and Managing Partner

What is Sasha Talebi's Phone Number?

Sasha Talebi's phone (213) ***-*418

What industry does Sasha Talebi work in?

Sasha Talebi works in the Venture Capital & Private Equity industry.

Sasha Talebi's Professional Skills Radar Chart

Based on our findings, Sasha Talebi is ...

What's on Sasha Talebi's mind?

Based on our findings, Sasha Talebi is ...

Sasha Talebi's Estimated Salary Range

Sasha Talebi Email Addresses

Sasha Talebi Phone Numbers

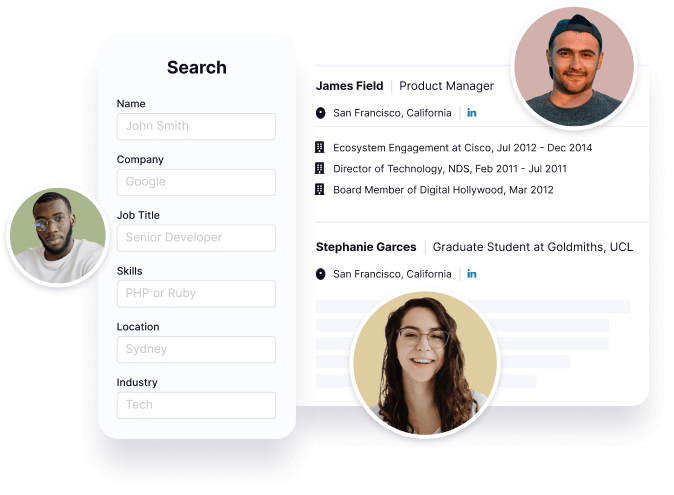

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Sasha Talebi's Ranking

Ranked #1,033 out of 20,660 for Founder and Managing Partner in California

Sasha Talebi's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Sasha Talebi's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 74% chance that Sasha Talebi is seeking for new opportunities

Top Searched People

American actor

German actor and former fashion model

Canadian ice hockey player

French basketball power forward

Actor

Sasha Talebi's Social Media Links

/in/sashatalebi