Samantha Williams's Email & Phone Number

Bachelor of Science - BS at North Carolina State University

Samantha Williams's Email Addresses

Samantha Williams's Phone Numbers

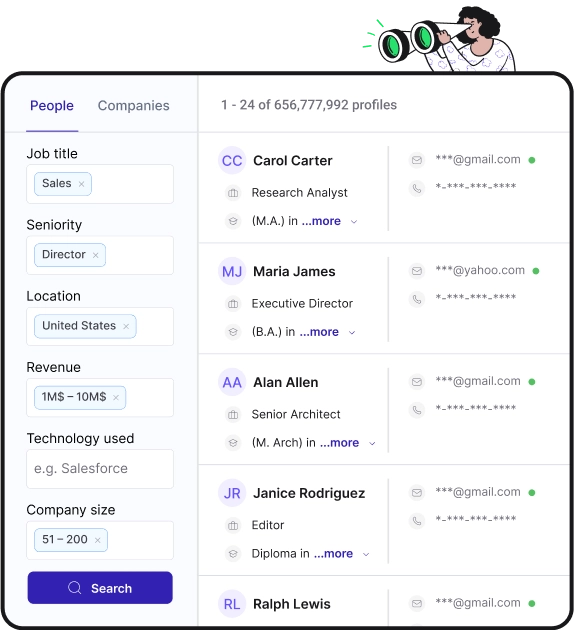

Find personal and work emails for over 300M professionals

Not the Samantha Williams you were looking for? Continue your search below:About Samantha Williams

📖 Summary

Samantha Williams is a dedicated and ambitious individual who recently completed her Bachelor of Science degree at North Carolina State University. Throughout her time at NCSU, Samantha has demonstrated a strong passion for her field of study and has excelled in both her academic pursuits and extracurricular activities.

As a student in the Bachelor of Science program, Samantha chose to focus her studies on environmental science and natural resource management. She has always been deeply passionate about the environment and sustainability, and this program enabled her to delve deeper into her interests while gaining a comprehensive understanding of the scientific principles behind environmental issues. Samantha's coursework included topics such as ecology, conservation biology, and environmental policy, and she consistently earned top marks for her exceptional performance in these classes.

In addition to her academic achievements, Samantha was actively involved in various environmental and sustainability organizations on campus. She was a member of the NCSU Environmental Club, where she participated in organizing events and initiatives to raise awareness about environmental issues and promote sustainable practices within the university community. Samantha also completed an internship with a local environmental nonprofit, where she gained valuable hands-on experience in conservation efforts and community outreach.

Samantha's dedication to her studies and her commitment to making a positive impact on the environment have not gone unnoticed. She was awarded the Outstanding Student in Environmental Science award by the NCSU Department of Environmental Science, a testament to her hard work and leadership in her field.

Looking ahead, Samantha is eager to apply her knowledge and skills in the real world. She is currently exploring opportunities for graduate school and is considering pursuing a master's degree in environmental management or a related field. Samantha is also interested in gaining practical experience through internships or entry-level positions in environmental consulting, conservation organizations, or government agencies.

As she moves forward in her career, Samantha is determined to continue making meaningful contributions to environmental conservation and sustainability. She is driven by a deep-seated desire to protect the natural world and create a more sustainable future for generations to come. With her strong academic foundation, hands-on experience, and unwavering passion, Samantha is poised to become a leader in the field of environmental science and make a lasting impact on the world around her.

In conclusion, Samantha Williams is a dedicated, passionate individual who has demonstrated exceptional academic achievement and a strong commitment to environmental conservation and sustainability. Her Bachelor of Science degree from North Carolina State University has provided her with a solid foundation in environmental science and natural resource management, and she is eager to apply her knowledge and skills in the real world. With her outstanding academic record, hands-on experience, and unwavering dedication, Samantha is poised to become a leader in her field and make a significant impact on the environment. She is a true asset to any organization and is sure to achieve great success in her future endeavors.

Samantha Williams's Email Addresses

Samantha Williams's Phone Numbers

People you may be

interested in

American basketball point guard

Internet personality

American talent manager

American media personality

American musician and singer-songwriter

Football running back

Journalist

Football wide receiver

Canadian actress

German model

American singer

Football quarterback