Adam Turner's Email & Phone Number

Global Veterinary Recruitment & Talent Strategy Specialist | UK, EU, AUS, NZ, UAE, USA | +44 (0) 7817 912 911

Adam Turner Email Addresses

Adam Turner Phone Numbers

Adam Turner's Work Experience

Global Veterinary Careers

Director | Recruiter

January 2018 to Present

Global Veterinary Careers

Recruiter | Director

February 2018 to Present

We Are SSG

New Business Development

November 2016 to July 2017

Liberty Vets Recruitment

Co-Founder & Director

July 2013 to July 2017

RIG Veterinary Recruitment

Senior Recruitment Consultant

September 2007 to January 2013

Global Veterinary Careers

Recruiter Director

Global Veterinary Careers

Recruiter

Show more

Show less

Adam Turner's Education

Exmouth Community College

January 1997 to January 2002

Show more

Show less

Frequently Asked Questions about Adam Turner

What company does Adam Turner work for?

Adam Turner works for Global Veterinary Careers

What is Adam Turner's role at Global Veterinary Careers?

Adam Turner is Director | Recruiter

What is Adam Turner's personal email address?

Adam Turner's personal email address is ad****[email protected]

What is Adam Turner's business email address?

Adam Turner's business email address is a****[email protected]

What is Adam Turner's Phone Number?

Adam Turner's phone +44 ** **** *338

What industry does Adam Turner work in?

Adam Turner works in the Staffing & Recruiting industry.

Adam Turner's Professional Skills Radar Chart

Based on our findings, Adam Turner is ...

What's on Adam Turner's mind?

Based on our findings, Adam Turner is ...

Adam Turner's Estimated Salary Range

Adam Turner Email Addresses

Adam Turner Phone Numbers

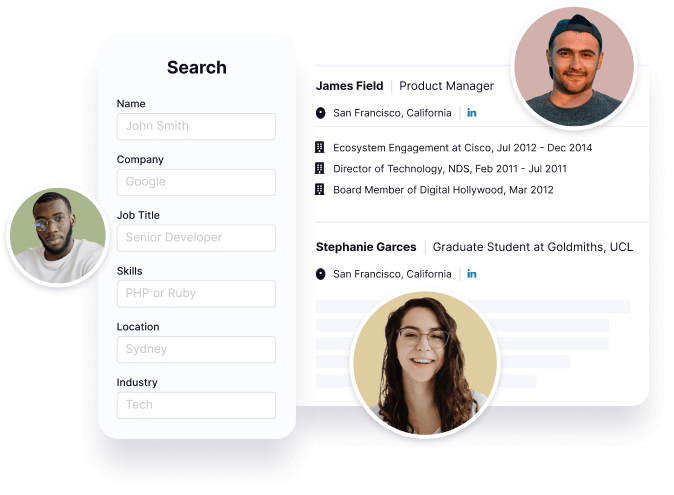

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Adam Turner's Personality Type

Extraversion (E), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Adam Turner's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 92% chance that Adam Turner is seeking for new opportunities

Top Searched People

English actress and director

Michael Lohan's wife

Soccer player

American actress

Actress

Adam Turner's Social Media Links

/in/adam-turner-a24ba31b www.libertystarrecruitment.co.uk