Rian Spencer's Email & Phone Number

Private Wealth Advisor-Director at BMO Wealth Management - U.S.

Rian Spencer Email Addresses

Rian Spencer Phone Numbers

Rian Spencer's Work Experience

Mountain View Elementary School

5th grade Dual Language Teacher

July 2001 to June 2002

Bohler-Uddeholm AG

Inside Sales

April 2000 to October 2000

Illinois Tool Works

Domestic Sales Coordinator

June 1999 to March 2000

U.S.

Private Wealth Advisor-Director - BMO Wealth Management

Show more

Show less

Rian Spencer's Education

Buffalo Grove High School

April 1990 to April 1991

Maine East High School

April 1989 to April 1990

Roosevelt University

M.B.A., Concentration: Real Estate

April 2024 to April 2024

Ohio University

Bachelor of Arts, Major: Spanish | Minor: History & Philosophy

April 1993 to April 1998

Meigs High School

High School Diploma, College/University Preparatory

April 1991 to April 1993

Show more

Show less

Frequently Asked Questions about Rian Spencer

What company does Rian Spencer work for?

Rian Spencer works for U.S.

What is Rian Spencer's role at U.S.?

Rian Spencer is Private Wealth Advisor-Director - BMO Wealth Management

What is Rian Spencer's personal email address?

Rian Spencer's personal email address is m****[email protected]

What is Rian Spencer's business email address?

Rian Spencer's business email address is r****[email protected]

What is Rian Spencer's Phone Number?

Rian Spencer's phone (**) *** *** 351

What industry does Rian Spencer work in?

Rian Spencer works in the Financial Services industry.

Rian Spencer's Professional Skills Radar Chart

Based on our findings, Rian Spencer is ...

What's on Rian Spencer's mind?

Based on our findings, Rian Spencer is ...

Rian Spencer's Estimated Salary Range

Rian Spencer Email Addresses

Rian Spencer Phone Numbers

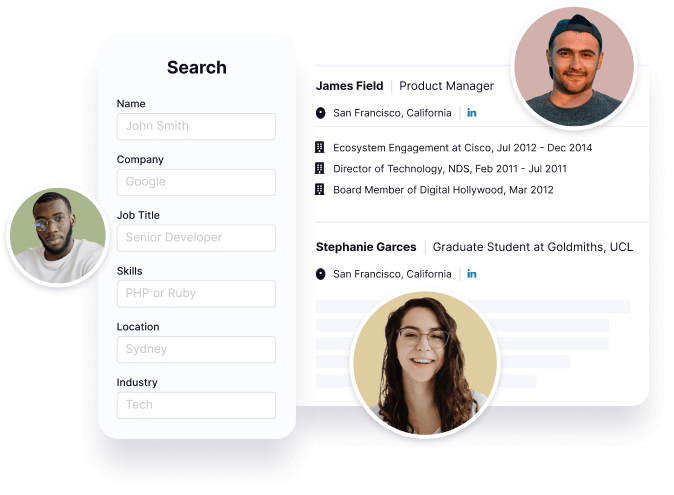

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Rian Spencer's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Rian Spencer's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 79% chance that Rian Spencer is seeking for new opportunities

Rian Spencer's Social Media Links

/in/rianspencer /company/bmowealthmanagement-us /school/roosevelt-university/