Philippe Gelis's Email & Phone Number

CEO and Co-founder at Kantox

Philippe Gelis Email Addresses

Philippe Gelis Phone Numbers

Philippe Gelis's Work Experience

Decelera

Experience Maker

June 2015 to Present

The Galion Project

Member

June 2015 to Present

COVIRTUA

Investor and Board member

October 2020 to Present

Syra Coffee

Investor

August 2020 to Present

Graneet

Investor and Board member

April 2020 to Present

yzr

Investor

January 2021 to Present

Antares Consulting

Consultant - Strategy & Operations

September 2005 to October 2007

SC Agora

Headhunter IT industry

October 2003 to August 2005

Renault

Financial controller (Internship)

August 2001 to June 2002

Show more

Show less

Philippe Gelis's Education

TBS Education

January 1999 to January 2003

Instituto Tecnológico y de Estudios Superiores de Monterrey

January 2002 to January 2003

Lycée Ozenne

January 1997 to January 1999

Show more

Show less

Frequently Asked Questions about Philippe Gelis

What is Philippe Gelis email address?

Email Philippe Gelis at [email protected], [email protected] and [email protected]. This email is the most updated Philippe Gelis's email found in 2024.

What is Philippe Gelis phone number?

Philippe Gelis phone number is +44.2081333531 and 0033468271005.

How to contact Philippe Gelis?

To contact Philippe Gelis send an email to [email protected], [email protected] or [email protected]. If you want to call Philippe Gelis try calling on +44.2081333531 and 0033468271005.

What company does Philippe Gelis work for?

Philippe Gelis works for Kantox

What is Philippe Gelis's role at Kantox?

Philippe Gelis is CEO and Co-founder

What industry does Philippe Gelis work in?

Philippe Gelis works in the Financial Services industry.

Philippe Gelis's Professional Skills Radar Chart

Based on our findings, Philippe Gelis is ...

What's on Philippe Gelis's mind?

Based on our findings, Philippe Gelis is ...

Philippe Gelis's Estimated Salary Range

Philippe Gelis Email Addresses

Philippe Gelis Phone Numbers

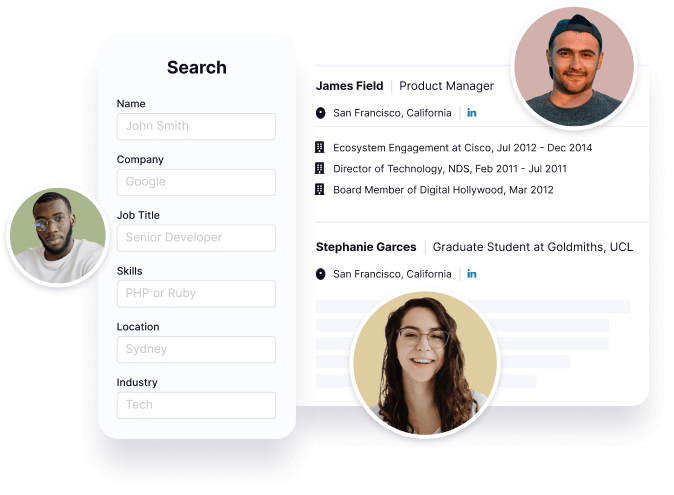

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Philippe Gelis's Personality Type

Introversion (I), Sensing (S), Feeling (F), Perceiving (P)

Average Tenure

2 year(s), 0 month(s)

Philippe Gelis's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 76% chance that Philippe Gelis is seeking for new opportunities

Top Searched People

Taoiseach

British actor and director

Cheerleader

American rapper

American television actor

Philippe Gelis's Social Media Links

/in/philippegelis www.kantox.com blog.kantox.com vimeo.com