John Ramirez's Email & Phone Number

YouTuber

John Ramirez's Email Addresses

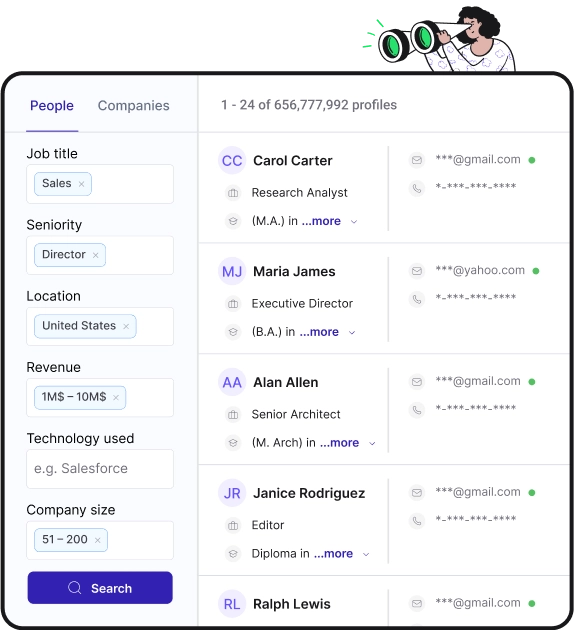

Find personal and work emails for over 300M professionals

Not the John Ramirez you were looking for? Continue your search below:About John Ramirez

📖 Summary

John Ramirez is a rising star in the world of YouTube, captivating his audience with his charismatic personality and unique content. With over a million subscribers, John has become a favorite among viewers from all walks of life. His videos range from comedic sketches to heartfelt vlogs, ensuring that there is something for everyone in his growing community.

When you watch one of John's videos, you can't help but be drawn in by his infectious energy. His authentic and relatable nature shines through in every frame, making you feel like you are chatting with an old friend. Whether he is pulling pranks on his friends or sharing his personal experiences, John has a way of making you feel like a part of his world.

One of the things that sets John apart from other YouTubers is his ability to make viewers laugh. His comedic sketches are brilliantly executed, leaving his audience in stitches every time. From outrageous characters to hilariously awkward situations, John's sketches are a testament to his comedic genius. Whether you need a little pick-me-up or a good laugh after a long day, John's videos are guaranteed to put a smile on your face.

Beyond the laughs, John also uses his platform to share deeper insights and real-life experiences. His vlogs give viewers a glimpse into his day-to-day life, as he takes them along on his adventures and opens up about his thoughts and emotions. From discussing mental health to sharing stories of personal growth, John isn't afraid to tackle challenging topics and connect with his audience on a more profound level.

In addition to his entertaining content, John is also known for his dedication to his followers. He regularly engages with his audience, responding to comments and messages, and even organizing meet-ups to interact with fans in person. This level of interaction has fostered a genuine sense of community among his subscribers, who often refer to themselves as "John's family." It is this strong bond that makes John's channel feel like more than just a platform for entertainment – it feels like a safe space where people can come together and support one another.

Furthermore, John has used his platform to give back to the community and make a positive impact. He has collaborated with various charitable organizations, raising awareness and funds for causes close to his heart. Whether it's supporting mental health initiatives or advocating for animal rights, John's commitment to making the world a better place shines through in his actions.

In conclusion, John Ramirez is more than just a YouTuber – he is a talented content creator who has built a loving, engaged community around his channel. With his infectious energy, comedic prowess, and willingness to tackle important issues, John has captivated audiences far and wide. Through his videos, he brings laughter, inspiration, and a sense of togetherness, making his channel a must-watch for anyone seeking quality entertainment and genuine connection.

John Ramirez's Email Addresses

People you may be

interested in

Indian actress and director

American professional wrestler

Canadian-American actor

American actor and motorsports racing driver

Trinidadian rapper and singer-songwriter

Cameroonian basketball player

Turkish football manager

American musician and singer-songwriter

South African actress and singer

Football quarterback

American stunt performer and actor

Internet personality