Patrick Kabeya's Email & Phone Number

Sr. AML /Bank Secrecy Act (BSA) and Counter- Terrorism Financing (CTF).

Patrick Kabeya Email Addresses

Patrick Kabeya's Work Experience

Sr. AML/Counter-Financing of Terrorism & Sanctions Project Lead Examiner

January 2016 to Present

Sr. AML/ Transactions Monitoring & Regulatory Compliance Lead Examiner

January 2014 to January 2016

Deutsche Bank

AML Analyst/Transactions Monitoring Investigator

January 2005 to January 2012

Show more

Show less

Patrick Kabeya's Education

Pfeiffer University

January 2002 to January 2007

Pfeiffer University

January 2015 to January 2017

Show more

Show less

Frequently Asked Questions about Patrick Kabeya

What company does Patrick Kabeya work for?

Patrick Kabeya works for Federal Reserve Bank of New York

What is Patrick Kabeya's role at Federal Reserve Bank of New York?

Patrick Kabeya is Sr. AML/Counter-Financing of Terrorism & Sanctions Project Lead Examiner

What is Patrick Kabeya's personal email address?

Patrick Kabeya's personal email address is p****[email protected]

What is Patrick Kabeya's business email address?

Patrick Kabeya's business email address is patrick.kabeya@***.***

What is Patrick Kabeya's Phone Number?

Patrick Kabeya's phone (704) ***-*393

What industry does Patrick Kabeya work in?

Patrick Kabeya works in the Banking industry.

Patrick Kabeya's Professional Skills Radar Chart

Based on our findings, Patrick Kabeya is ...

What's on Patrick Kabeya's mind?

Based on our findings, Patrick Kabeya is ...

Patrick Kabeya's Estimated Salary Range

Patrick Kabeya Email Addresses

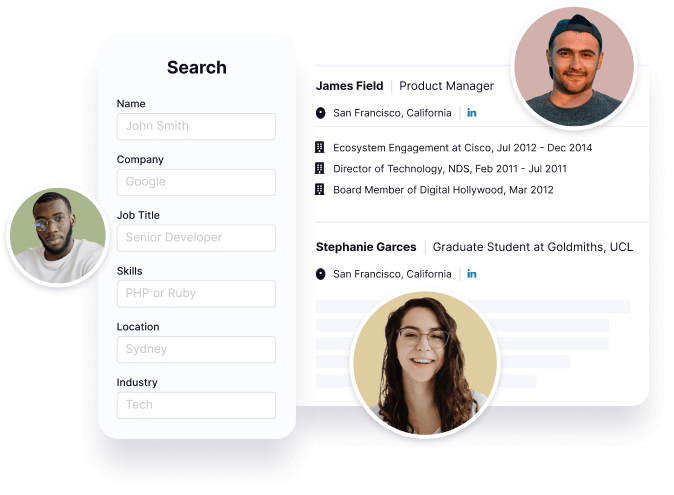

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Patrick Kabeya's Ranking

Ranked #357 out of 7,144 for Sr. AML/Counter-Financing of Terrorism & Sanctions Project Lead Examiner in North Carolina

Patrick Kabeya's Personality Type

Extraversion (E), Sensing (S), Thinking (T), Perceiving (P)

Average Tenure

2 year(s), 0 month(s)

Patrick Kabeya's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 91% chance that Patrick Kabeya is seeking for new opportunities

Top Searched People

Actor

American actor

American actor and director

American actress and singer

Canadian actor and model

Patrick Kabeya's Social Media Links

/in/patrick-kabeya-msffi-641a393a