Nick Maroulis's Email & Phone Number

.NET Lead, Manager at Cognizant

Nick Maroulis Email Addresses

Nick Maroulis's Work Experience

Cognizant

.NET Lead, Manager

Project Consultant - Banking Regulatory Projects

IT BA - Data Migration T24/SQL Server

T24 Business Engineer

KBL Kredietbank Luxembourg

T24 Senior Analyst

Deutsche Bank (Suisse) SA

Senior T24 Consultant [Finance Team]

Banque de la Poste, Belgium

T24 Senior Business Consultant

Raiffeisen Bank, Luxembourg

T24 Senior Business Analyst (Assets Management)

Bank of Attica

GLOBUS Senior Analyst (IT Dept)

GLOBUS Banking Analyst

Investment Bank (Ependytiki Trapeza)

GLOBUS Banking Analyst

Informer SA

GLOBUS Banking Analyst

Tirana Bank, Tirana, Albania

Treasury Director

FOREX Dealer

EUROSEC Stock Brokers

Stock Broker [Shares/ Series 7]

Show more

Show less

Nick Maroulis's Education

Pearson College London

HND Diploma in Computing and Systems Development

University of Oxford

Advanced Diploma in Data and Systems Analysis

OM Institute, Sweden

Diploma

Greek Institute of Operational Research

Certificate

Hellenic Bank Association

FOREX

Athens University of Economics and Business

Certificate

CSV Ltd

Certificates

City College

MA

Reuters

Certificate

Eurocenter

Certificate

Chartered Institute of Marketing

Diploma

CONTROL DATA Corp. (CDC) Institute

Diploma

Show more

Show less

Frequently Asked Questions about Nick Maroulis

What is Nick Maroulis email address?

Email Nick Maroulis at [email protected] and [email protected]. This email is the most updated Nick Maroulis's email found in 2024.

What is Nick Maroulis phone number?

Nick Maroulis phone number is +41.795614781 and +30.6945803064.

How to contact Nick Maroulis?

To contact Nick Maroulis send an email to [email protected] or [email protected]. If you want to call Nick Maroulis try calling on +41.795614781 and +30.6945803064.

What company does Nick Maroulis work for?

Nick Maroulis works for Cognizant

What is Nick Maroulis's role at Cognizant?

Nick Maroulis is .NET Lead, Manager

What industry does Nick Maroulis work in?

Nick Maroulis works in the Banking industry.

Nick Maroulis's Professional Skills Radar Chart

Based on our findings, Nick Maroulis is ...

What's on Nick Maroulis's mind?

Based on our findings, Nick Maroulis is ...

Nick Maroulis's Estimated Salary Range

Nick Maroulis Email Addresses

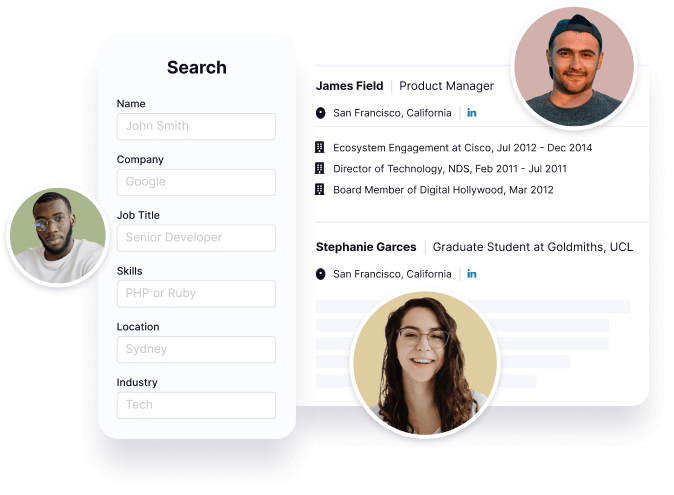

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Nick Maroulis's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Nick Maroulis's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 89% chance that Nick Maroulis is seeking for new opportunities

Top Searched People

American actor

American poet

Former Member of the House of Lords of the United Kingdom

American singer

American singer-songwriter

Nick Maroulis's Social Media Links

/in/nickmaroulis