Madina Nigmatulina's Email & Phone Number

Accounting, finance and regulatory lead for financial services companies

Madina Nigmatulina Email Addresses

Madina Nigmatulina's Work Experience

Director (Office of Chief Accountant – Corporate Accounting Policy and External Reporting)

March 2013 to June 2016

Lehman Brothers

Vice President in Accounting Policy Group and External Reporting

June 2006 to November 2008

Senior Director and Head of Accounting and Regulatory Advisory

Show more

Show less

Frequently Asked Questions about Madina Nigmatulina

What company does Madina Nigmatulina work for?

Madina Nigmatulina works for RBC

What is Madina Nigmatulina's role at RBC?

Madina Nigmatulina is Senior Director Head of US Finance Risk and Control

What is Madina Nigmatulina's personal email address?

Madina Nigmatulina's personal email address is m****[email protected]

What is Madina Nigmatulina's business email address?

Madina Nigmatulina's business email address is madina.nigmatulina@***.***

What is Madina Nigmatulina's Phone Number?

Madina Nigmatulina's phone (212) ***-*415

What industry does Madina Nigmatulina work in?

Madina Nigmatulina works in the Accounting industry.

Madina Nigmatulina's Professional Skills Radar Chart

Based on our findings, Madina Nigmatulina is ...

What's on Madina Nigmatulina's mind?

Based on our findings, Madina Nigmatulina is ...

Madina Nigmatulina's Estimated Salary Range

Madina Nigmatulina Email Addresses

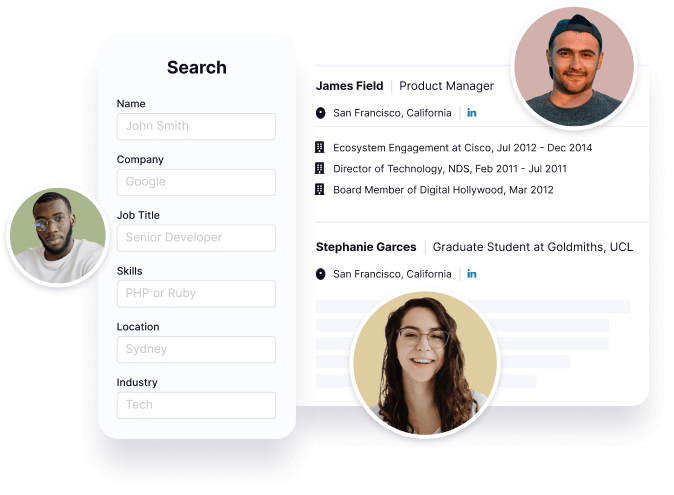

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Madina Nigmatulina's Ranking

Ranked #558 out of 11,168 for Senior Director Head of US Finance Risk and Control in New York

Madina Nigmatulina's Personality Type

Extraversion (E), Sensing (S), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Madina Nigmatulina's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 88% chance that Madina Nigmatulina is seeking for new opportunities

Madina Nigmatulina's Social Media Links

/in/madina-nigmatulina-5b91174 /company/rbc /school/%d0%bc%d0%be%d1%81%d0%ba%d0%be%d0%b2%d1%81%d0%ba%d0%b8%d0%b9-%d0%b3%d0%be%d1%81%d1%83%d0%b4%d0%b0%d1%80%d1%81%d1%82%d0%b2%d0%b5%d0%bd%d0%bd%d1%8b%d0%b9-%d1%83%d0%bd%d0%b8%d0%b2%d0%b5%d1%80%d1%81%d0%b8%d1%82%d0%b5%d1%82-%d0%b8%d0%bc.-%d0%bc.%d0%b2.-%d0%bb%d0%be%d0%bc%d0%be%d0%bd%d0%be%d1%81%d0%be%d0%b2%d0%b0-%d0%bc%d0%b3%d1%83-/