Joachim Von Hoyningen-Huene's Email & Phone Number

Managing Director Value Businesses at Johnson Matthey

Joachim Von Hoyningen-Huene Email Addresses

Joachim Von Hoyningen-Huene Phone Numbers

Joachim Von Hoyningen-Huene's Work Experience

Johnson Matthey

Managing Director Value Businesses at Johnson Matthey

January 2020 to Present

Bain & Company

Partner at Bain & Company | Chemicals Lead Partner for Germany, Switzerland & Austria (GSD)

January 2018 to January 2020

Partner at A.T. Kearney | Co-Lead Process Industries & Lead of M&A and PE Practice in GSD

January 2002 to January 2017

Show more

Show less

Frequently Asked Questions about Joachim Von Hoyningen-Huene

What is Joachim Von Hoyningen-huene email address?

Email Joachim Von Hoyningen-huene at [email protected]. This email is the most updated Joachim Von Hoyningen-huene's email found in 2024.

How to contact Joachim Von Hoyningen-huene?

To contact Joachim Von Hoyningen-huene send an email to [email protected].

What company does Joachim Von Hoyningen-Huene work for?

Joachim Von Hoyningen-Huene works for Johnson Matthey

What is Joachim Von Hoyningen-Huene's role at Johnson Matthey?

Joachim Von Hoyningen-Huene is Managing Director Value Businesses at Johnson Matthey

What is Joachim Von Hoyningen-Huene's Phone Number?

Joachim Von Hoyningen-Huene's phone (**) *** *** 243

What industry does Joachim Von Hoyningen-Huene work in?

Joachim Von Hoyningen-Huene works in the Management Consulting industry.

Joachim Von Hoyningen-Huene Email Addresses

Joachim Von Hoyningen-Huene Phone Numbers

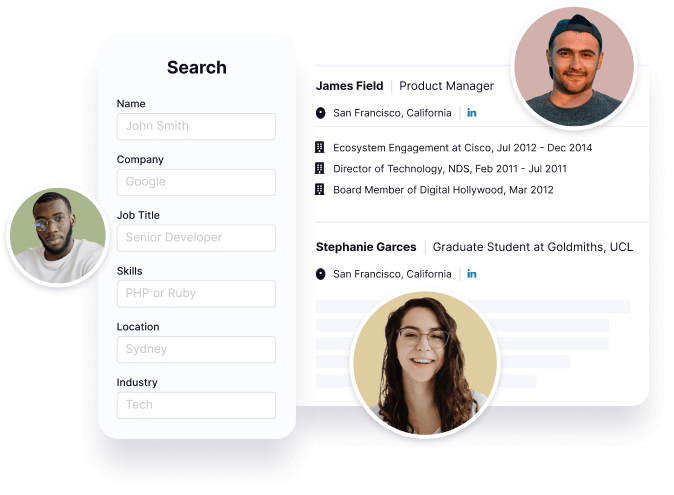

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Joachim Von Hoyningen-Huene's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Joachim Von Hoyningen-Huene's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 78% chance that Joachim Von Hoyningen-Huene is seeking for new opportunities

Joachim Von Hoyningen-Huene's Social Media Links

/in/joachimvonhoyningenhuene