James Oconnor's Email & Phone Number

Global Head of Venture Capital and Managing Director at William Blair & Company

James Oconnor Email Addresses

James Oconnor Phone Numbers

James Oconnor's Work Experience

Chicagoland Entrepreneurial Center

Founder and Chairman

January 2003 to Present

U.S. Department of the Treasury

White House Fellowship - U.S. Treasury Department

September 1998 to Present

Motorola

Chief Innovation Officer - Corporate Vice President, Technology Acceleration

January 2004 to December 2007

Motorola

Motorola Ventures - Board Observer and Investor

September 1999 to December 2007

Motorola

Corporate Director - Intellectual Property and Standards Policy

January 2004 to November 2007

Motorola

Co-Founder and Managing Director

September 1999 to January 2004

U.S. House of Representatives

Intern - Ways and Means Committee

September 1992 to May 1994

Knauthe Paul Schmitt

Summer Associate

June 1992 to August 1992

Pax High School Volunteer teacher

Volunteer Teacher

January 1990 to January 1991

Lloyd's of London

Associate Broker

August 1989 to December 1989

U.S. House of Representatives

Intern

January 1987 to June 1989

McKay Contractors

Construction Worker

June 1988 to August 1988

Chairman of the Board & Co-Founder

Show more

Show less

James Oconnor's Education

Loyola Academy

St. Joan of Arc

Northwestern University - Kellogg School of Management

Georgetown University Law Center

The London School of Economics and Political Science (LSE)

Georgetown University

Trinity College Dublin

Show more

Show less

Frequently Asked Questions about James Oconnor

What is James J Oconnor email address?

Email James J Oconnor at [email protected], [email protected] and [email protected]. This email is the most updated James J Oconnor's email found in 2024.

How to contact James J Oconnor?

To contact James J Oconnor send an email to [email protected], [email protected] or [email protected].

What company does James Oconnor work for?

James Oconnor works for William Blair

What is James Oconnor's role at William Blair?

James Oconnor is Global Head of Venture Capital and Managing Director

What is James Oconnor's Phone Number?

James Oconnor's phone (217) ***-*564

What industry does James Oconnor work in?

James Oconnor works in the Venture Capital & Private Equity industry.

James Oconnor's Professional Skills Radar Chart

Based on our findings, James Oconnor is ...

What's on James Oconnor's mind?

Based on our findings, James Oconnor is ...

James Oconnor's Estimated Salary Range

James Oconnor Email Addresses

James Oconnor Phone Numbers

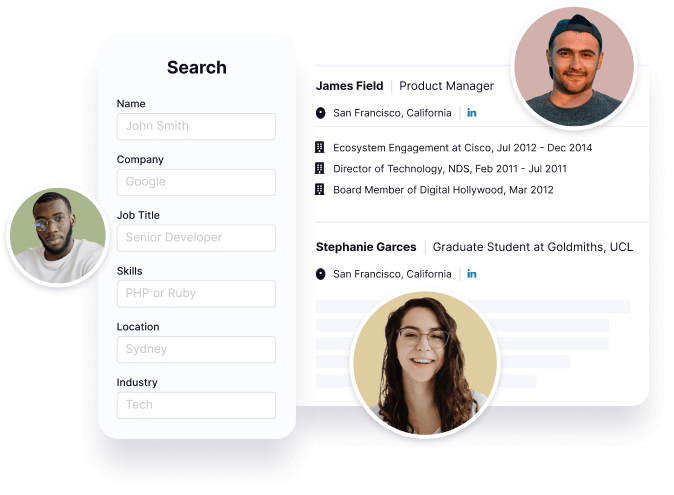

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

James Oconnor's Ranking

Ranked #322 out of 6,437 for Global Head of Venture Capital and Managing Director in Illinois

James Oconnor's Personality Type

Extraversion (E), Sensing (S), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

James Oconnor's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 79% chance that James Oconnor is seeking for new opportunities

Top Searched People

American news anchor

Jet Li's daughter

American journalist

CEO of Citigroup

Former Member of the San Francisco Board of Supervisors

James Oconnor's Social Media Links

/in/jimo4