Irfan Tareen's Email & Phone Number

Global Business Leader: Identity, Fraud and Compliance at Equifax

Irfan Tareen Email Addresses

Irfan Tareen's Work Experience

Equifax

Global Business Leader: Identity, Fraud and Compliance

January 2020 to Present

Center

VP Business Development and Financial Operations

January 2016 to January 2019

American Express

VP Products

January 2015 to January 2016

American Express

VP Risk

January 2013 to January 2015

PayPal

Retail Risk Strategist

January 2012 to January 2013

PayPal

Global Risk Strategist

January 2011 to January 2012

American Express

Director, GNS Risk Management

January 2003 to January 2007

American Express

Senior Manager, International Risk Management

January 2001 to January 2003

Show more

Show less

Irfan Tareen's Education

The University of Georgia

Ph.D., Economics

Lock Haven University of Pennsylvania

Bachelor of Science (BS), Management Science / Finance & Economics

Aitchison College

FA, Economics, Statistics

The University of Georgia

Master's Degree, Economics and Applied Statistics

Show more

Show less

Frequently Asked Questions about Irfan Tareen

What company does Irfan Tareen work for?

Irfan Tareen works for Equifax

What is Irfan Tareen's role at Equifax?

Irfan Tareen is Global Business Leader: Identity, Fraud and Compliance

What is Irfan Tareen's personal email address?

Irfan Tareen's personal email address is i****[email protected]

What is Irfan Tareen's business email address?

Irfan Tareen's business email address is irfan.tareen@***.***

What is Irfan Tareen's Phone Number?

Irfan Tareen's phone (404) ***-*119

What industry does Irfan Tareen work in?

Irfan Tareen works in the Financial Services industry.

Irfan Tareen's Professional Skills Radar Chart

Based on our findings, Irfan Tareen is ...

What's on Irfan Tareen's mind?

Based on our findings, Irfan Tareen is ...

Irfan Tareen's Estimated Salary Range

Irfan Tareen Email Addresses

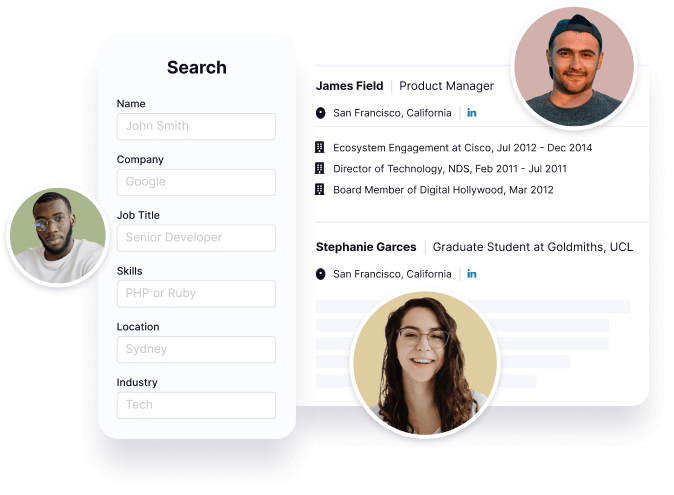

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Irfan Tareen's Ranking

Ranked #269 out of 5,380 for Global Business Leader: Identity, Fraud and Compliance in Georgia

Irfan Tareen's Personality Type

Extraversion (E), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Irfan Tareen's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 92% chance that Irfan Tareen is seeking for new opportunities

Irfan Tareen's Social Media Links

/in/irfantareen092007 /redir/redirect /school/university-of-georgia/ /company/equifax