David Lawford Mee's Email & Phone Number

Enterprise Sales Manager - Public Sector @ LinkedIn

David Lawford Mee Email Addresses

David Lawford Mee Phone Numbers

David Lawford Mee's Work Experience

Cisco Systems

Business Manager

January 1999 to January 2010

Show more

Show less

Frequently Asked Questions about David Lawford Mee

What is David Lawford Mee email address?

Email David Lawford Mee at [email protected] and [email protected]. This email is the most updated David Lawford Mee's email found in 2024.

What is David Lawford Mee phone number?

David Lawford Mee phone number is 07808784306 (Mobile).

How to contact David Lawford Mee?

To contact David Lawford Mee send an email to [email protected] or [email protected]. If you want to call David Lawford Mee try calling on 07808784306 (Mobile).

What company does David Lawford Mee work for?

David Lawford Mee works for LinkedIn

What is David Lawford Mee's role at LinkedIn?

David Lawford Mee is Enterprise Sales Manager - Public Sector

What industry does David Lawford Mee work in?

David Lawford Mee works in the Internet industry.

David Lawford Mee Email Addresses

David Lawford Mee Phone Numbers

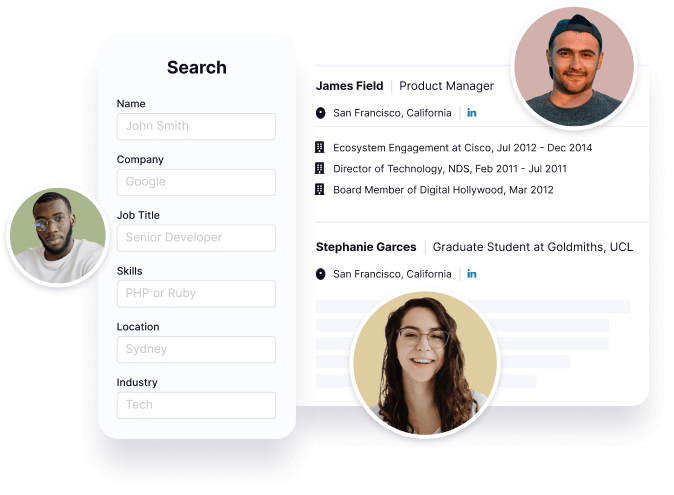

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

David Lawford Mee's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

David Lawford Mee's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 89% chance that David Lawford Mee is seeking for new opportunities

David Lawford Mee's Social Media Links

/in/davidlawfordmee