David Purdy's Email & Phone Number

Loan Originator

David Purdy's Email Addresses

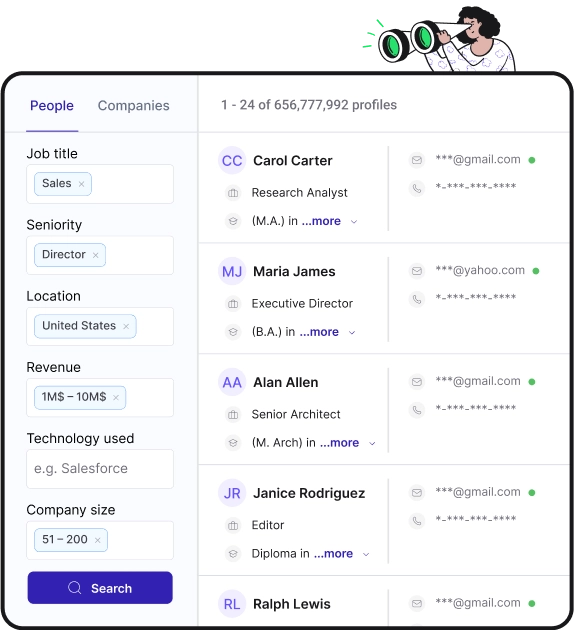

Find personal and work emails for over 300M professionals

Not the David Purdy you were looking for? Continue your search below:About David Purdy

📖 Summary

David Purdy is a Loan Originator with a passion for helping clients achieve their dreams of homeownership. With years of experience in the mortgage industry, David is committed to providing personalized, high-quality service to each and every client. Whether you are a first-time homebuyer or a seasoned investor, David has the knowledge and expertise to guide you through the loan process and find the best financing solution for your unique needs.

David understands that obtaining a mortgage can be a daunting task, and he is dedicated to making the process as smooth and stress-free as possible. He takes the time to listen to his clients' goals and financial situations, and works diligently to find the right loan program to fit their needs. With his in-depth knowledge of the ever-changing mortgage market, David is able to offer valuable insights and advice to help his clients make informed decisions about their home financing.

One of David's greatest strengths is his ability to communicate effectively with clients, real estate agents, and other professionals involved in the loan process. He prides himself on his attention to detail and his proactive approach to keeping all parties informed and on track throughout the transaction. David is known for his responsiveness and willingness to go the extra mile to ensure a positive experience for his clients from start to finish.

In addition to his exceptional customer service, David is also well-versed in a wide range of loan products, including conventional, FHA, VA, and jumbo loans. He understands that each client's financial situation is unique, and he works diligently to find the best financing solution for their individual needs. Whether you are looking to purchase a new home, refinance an existing loan, or explore investment opportunities, David has the expertise to help you achieve your goals.

David is committed to staying current with industry trends and regulations, and he continuously seeks out opportunities for professional development to enhance his skills and knowledge. He understands the importance of staying ahead of the curve in order to provide the best possible service to his clients. With his dedication to ongoing education and his commitment to excellence, David is well-equipped to navigate the complexities of the mortgage industry and deliver top-notch service to his clients.

Outside of his career as a Loan Originator, David is an active member of his local community and is passionate about giving back. He is involved in various charitable initiatives and is dedicated to making a positive impact on the lives of others. His commitment to serving others extends beyond his professional endeavors, and he is known for his generosity and willingness to lend a helping hand to those in need.

If you are searching for a knowledgeable, reliable, and dedicated Loan Originator to assist you with your home financing needs, look no further than David Purdy. With his expertise, personalized service, and commitment to excellence, David is the ideal partner to help you achieve your homeownership goals. Contact David today to experience the difference that a truly exceptional Loan Originator can make in your mortgage journey.

David Purdy's Email Addresses

People you may be

interested in

American singer and songwriter

American guitarist and singer-songwriter

Australian director and animator

American gospel singer and evangelist

American ice hockey right winger

Manhattan District Attorney

Actor and singer

Canadian actress

Writer

Author

American comedian and actress

Writer