Brandon Webb's Email & Phone Number

American baseball pitcher

Brandon Webb's Email Addresses

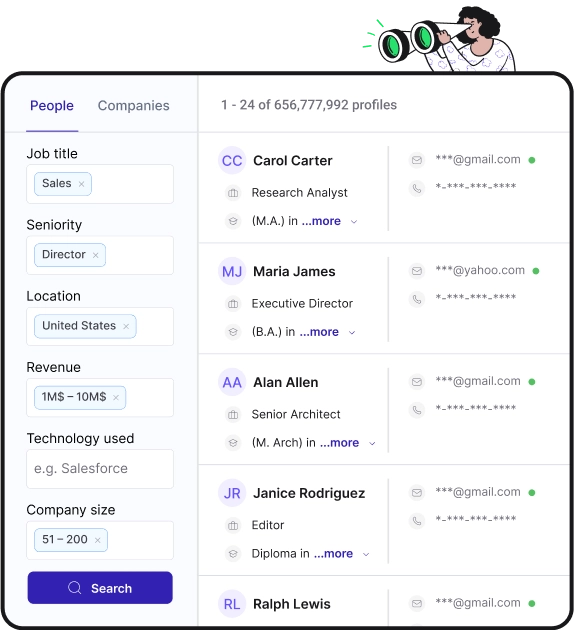

Find personal and work emails for over 300M professionals

Not the Brandon Webb you were looking for? Continue your search below:About Brandon Webb

📖 Summary

Brandon Webb is a former American professional baseball pitcher who played for the Arizona Diamondbacks in Major League Baseball. Born on May 9, 1979, in Ashland, Kentucky, Webb grew up with a passion for baseball and went on to have a successful career in the sport. Known for his powerful pitching and exceptional athletic ability, Webb became a standout player in the MLB and earned numerous accolades and recognition for his contributions to the game.

Webb's journey to the major leagues began when he was drafted by the Arizona Diamondbacks in the 1999 MLB draft. After working his way up through the minor leagues, Webb made his MLB debut in 2003 and quickly established himself as a dominant force on the pitcher's mound. With his impressive fastball and formidable control, Webb became a cornerstone of the Diamondbacks' pitching rotation and played a key role in the team's success.

Throughout his career, Webb earned numerous accolades and awards for his outstanding performance on the field. In 2006, he was named the National League Cy Young Award winner after leading the league in wins and earned run average (ERA). Webb's exceptional pitching helped the Diamondbacks clinch the NL West division title that year and made him a beloved figure among fans and teammates. His remarkable talent and dedication to the game solidified his place as one of the top pitchers in the league and garnered widespread respect from his peers.

Despite his early success, Webb's career took a turn when he suffered a shoulder injury that ultimately cut his time on the field short. The injury forced him to undergo multiple surgeries and extensive rehabilitation, and despite his efforts to return to the game, Webb was ultimately unable to make a full recovery. In 2013, he announced his retirement from professional baseball, marking an end to his incredible career in the sport.

While Webb's time as a player may have come to an end, his impact on the game of baseball continues to be felt to this day. His influence on the Diamondbacks and the sport as a whole is undeniable, and his legacy as a talented and dedicated athlete lives on. Webb's contributions to the game have left a lasting impression on fans and fellow players alike, and his passion for baseball continues to inspire new generations of athletes to pursue their own dreams on the field.

Beyond his accomplishments on the field, Webb has remained active in the baseball community, using his experience and knowledge to support and mentor young players. His dedication to the sport and his willingness to give back have made him a respected figure in the baseball world, and his impact reaches far beyond his time as a player. Whether he's providing guidance to aspiring athletes or sharing his love for the game with fans, Webb's presence in the baseball community is a testament to his enduring passion for the sport.

In addition to his contributions to the baseball world, Webb has also pursued other ventures outside of the sport. He has explored business opportunities and embraced new challenges, demonstrating his versatility and drive to succeed in various aspects of his life. Webb's determination and resilience, qualities that served him well on the pitcher's mound, have continued to guide him in his post-baseball endeavors, and his commitment to excellence remains unwavering.

Overall, Brandon Webb's legacy as a formidable pitcher and dedicated athlete has left an indelible mark on the world of baseball. His remarkable career, marked by outstanding achievements and unwavering passion for the game, will be remembered for years to come. As he continues to make an impact in the baseball community and beyond, Webb's influence serves as a source of inspiration for aspiring athletes and a reminder of the enduring power of the sport.

Frequently Asked Questions about Brandon Webb

What happened to Brandon Webb?

A series of shoulder injuries sidelined him for much of 2009-2012, and on February 4, 2013, Webb officially retired from Major League Baseball. He is currently a FOX Sports Arizona Pre and Postgame Show Analyst for the Arizona Diamondbacks.

What pitches did Brandon Webb throw?

Pitches. Webb was mainly known for his sinker, regarded on a par with Roy Halladay and Chien-Ming Wang's as among the best in baseball at its best. He threw it in the 87–91 mph range, a curveball (72–75), changeup (77–80), and occasionally a cutter against left-handed hitters.

Does Brandon Webb have a son?

Brandon Webb Bio. Brandon Tyler Webb ... he and his wife, Alicia, have a daughter, Reagan, and son, Austin ... was a 1997 graduate of Ashland (Ky.)

What did Brandon Webb do?

Brandon Webb (@brandontwebb) is a combat-decorated Navy SEAL sniper turned New York Times bestselling author & entrepreneur. In his twilight tour, he honed some of the military's most formidable snipers as the head sniper instructor for the U.S. Navy SEALs.

Brandon Webb's Email Addresses

People you may be

interested in

American professional wrestler

Retired. Actually never had a job that was work for a day in my life after high school.

Hi! I am a recent graduate of Catawba College. I obtained a Bachelor's Degree in Economics and Finance, minor in Business Administration in December 2022.

Realtor at Pacific Plains Realty

⚾️

Production Engineering Supervisor, Maintenance & Controls Support, Prototype Technican at Toyo Seat USA

Distribution Sales Director at Danfoss Power Solutions

Executive Vice President at Transwestern

Realtor at Sotheby's International Realty

Senior Content Manager at LexisNexis

Owner, Re-Transportation, Inc.

Master of Business Administration - MBA en Universidad Isabel I