Anthony Leonard's Email & Phone Number

Banking Professional

Anthony Leonard Email Addresses

Anthony Leonard Phone Numbers

Anthony Leonard's Work Experience

Credit Products Officer II - Watch List and Criticized Assets, Vice President - Franchise Finance

November 2019 to August 2021

Old Line Bank Formerly Bay Bank

Assistant Vice President, Special Assets Officer

February 2016 to October 2019

Bay Bank, FSB

Assistant Vice President, Special Assets Officer

May 2017 to April 2018

Bay Bank, FSB

Assistant Vice President, Credit Administration specializing in Commerical Real Estate

February 2016 to May 2017

Northwest Savings Bank

Regional Senior Credit Analyst - CRE and C&I

May 2012 to January 2014

Severn Savings Bank

Credit Analyst - C&I and CRE

August 2011 to May 2012

Construction Finance Manager

May 2010 to August 2011

Aerotek/Allegis Group

Corporate Credit/Risk Analyst

June 2004 to April 2008

A BankUnited Company

Credit Products Officer II - Watch List and Criticized Assets, Vice President - Franchise Finance - Bridge Funding Group

Show more

Show less

Anthony Leonard's Education

Stevenson University

January 2020 to January 2022

University of Maryland Global Campus

January 2014 to January 2018

Strayer University

January 2006 to January 2008

Mount Saint Joseph High School

January 2000 to January 2001

The Cardinal Gibbons School

January 1994 to January 1998

McDaniel College

January 2001 to January 2005

Show more

Show less

Frequently Asked Questions about Anthony Leonard

What is Anthony James Leonard email address?

Email Anthony James Leonard at [email protected], [email protected] and [email protected]. This email is the most updated Anthony James Leonard's email found in 2024.

What is Anthony James Leonard phone number?

Anthony James Leonard phone number is 4109000155.

How to contact Anthony James Leonard?

To contact Anthony James Leonard send an email to [email protected], [email protected] or [email protected]. If you want to call Anthony James Leonard try calling on 4109000155.

What company does Anthony Leonard work for?

Anthony Leonard works for Atlantic Union Bank

What is Anthony Leonard's role at Atlantic Union Bank?

Anthony Leonard is Vice President, Special Assets Officer

What industry does Anthony Leonard work in?

Anthony Leonard works in the Banking industry.

Anthony Leonard's Professional Skills Radar Chart

Based on our findings, Anthony Leonard is ...

What's on Anthony Leonard's mind?

Based on our findings, Anthony Leonard is ...

Anthony Leonard's Estimated Salary Range

Anthony Leonard Email Addresses

Anthony Leonard Phone Numbers

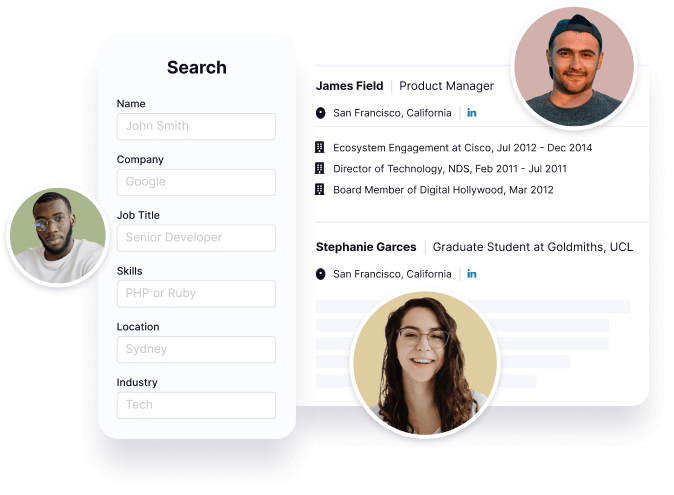

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Anthony Leonard's Ranking

Ranked #193 out of 3,852 for Vice President, Special Assets Officer in Maryland

Anthony Leonard's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Anthony Leonard's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 91% chance that Anthony Leonard is seeking for new opportunities

Anthony Leonard's Social Media Links

/in/anthony-james-leonard-mba-8b517812