Andrew Fastow's Email & Phone Number

Chief Financial Officer

Andrew Fastow's Email Addresses

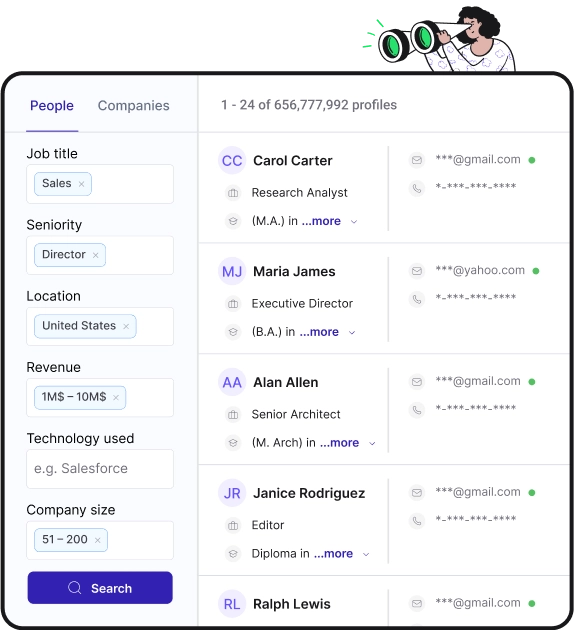

Find personal and work emails for over 300M professionals

Not the Andrew Fastow you were looking for? Continue your search below:About Andrew Fastow

📖 Summary

Andrew Fastow is a former Chief Financial Officer of Enron Corporation, a major energy company that infamously collapsed in 2001 due to widespread accounting fraud and corruption. Fastow played a central role in the scandal, orchestrating shady financial schemes that deceived investors, regulators, and the public while enriching himself and other company executives. His actions resulted in one of the largest bankruptcies in American history and led to the loss of thousands of jobs and billions of dollars in investor wealth.

Fastow was born in 1961 in Washington, D.C. and grew up in New Providence, New Jersey. He earned his bachelor's degree in economics and Chinese history from Tufts University and later obtained a master's degree in business administration from Northwestern University's Kellogg School of Management. After completing his education, Fastow joined Continental Illinois National Bank where he worked in the bank's energy division before moving to the finance department of the bank's energy division. It was during this time that he met Jeffrey Skilling, who would later become the CEO of Enron and play a key role in the company's downfall.

Fastow joined Enron in 1990 and quickly rose through the ranks to become the company's Chief Financial Officer in 1998. As CFO, Fastow was responsible for overseeing the company's financial activities and reporting, as well as managing its relationships with investors and financial institutions. Instead of fulfilling these responsibilities with integrity, Fastow used his position to engage in fraudulent activities that artificially inflated the company's financial statements and deceived investors and regulators about the company's true financial health.

One of Fastow's most notorious schemes was the creation and management of off-balance-sheet special purpose entities (SPEs) that were used to conceal Enron's debt, boost its stock price, and generate millions of dollars in personal profits for himself and other Enron executives. Fastow manipulated these entities to keep billions of dollars of Enron's debt off the company's books, allowing it to appear more financially healthy than it actually was. The complex web of these SPEs ultimately contributed to Enron's bankruptcy when their true nature was revealed, leading to criminal investigations, prosecutions, and convictions of key players including Fastow and other executives.

Fastow's actions at Enron were a stark example of corporate greed and dishonesty, and they had significant repercussions for the business world as a whole. His actions also prompted widespread reform of accounting and financial reporting standards, as well as increased scrutiny of corporate governance and oversight. Fastow himself was charged with multiple counts of fraud, money laundering, and conspiracy, and in 2002 he pleaded guilty to two counts of conspiracy and agreed to cooperate with prosecutors in exchange for a reduced sentence.

Fastow's cooperation led to the convictions of other Enron executives, including Skilling and former CEO Kenneth Lay, and he provided crucial testimony in various trials and investigations related to the Enron scandal. In 2006, he was sentenced to six years in federal prison and ordered to pay $23.8 million in restitution to Enron's shareholders. Additionally, Fastow's wife, Lea Fastow, was also convicted of tax evasion for her involvement in the financial schemes and served time in prison.

Since completing his prison sentence in 2011, Fastow has been actively involved in speaking engagements and consulting work, using his experiences and insights to educate others about the ethical implications of financial decision-making and the importance of corporate governance and transparency. He has spoken at universities, business conferences, and corporate events, sharing the lessons learned from the Enron scandal and advocating for responsible and ethical business practices.

While Fastow's actions at Enron have left a stain on his legacy and brought significant harm to countless individuals and institutions, his subsequent efforts to promote ethical leadership and corporate accountability demonstrate a commitment to preventing similar financial catastrophes in the future. His experiences continue to serve as a cautionary tale for the business world, emphasizing the importance of upholding integrity and ethical standards in all financial endeavors.

Andrew Fastow's Email Addresses

People you may be

interested in

American actress

TV writer

American actor and motorsports racing driver

Spanish screenwriter and radio host

American actor and director

American former football quarterback

American author

Comedian

Leadership and ethics advocate, known as the Enron whistleblower. Internationally recognized speaker on the topics of ethics, corporate governance, organizational behavior, and the toxic label of whis

Investor at KeenCorp

Pediatric Dentist

Tax Staff at EY